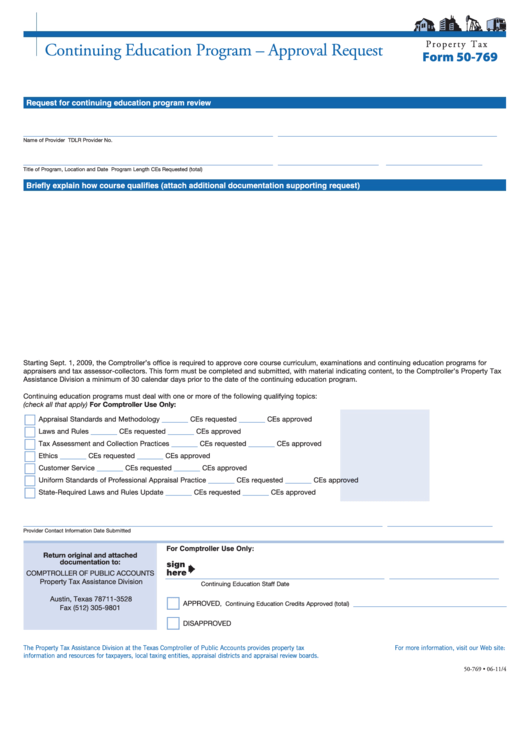

P r o p e r t y T a x

Continuing Education Program – Approval Request

Form 50-769

Request for continuing education program review

_________________________________________________________

__________________________________________________

Name of Provider

TDLR Provider No.

_________________________________________________________

_______________________

______________________

Title of Program, Location and Date

Program Length

CEs Requested (total)

Briefly explain how course qualifies (attach additional documentation supporting request)

Starting Sept. 1, 2009, the Comptroller’s office is required to approve core course curriculum, examinations and continuing education programs for

appraisers and tax assessor-collectors. This form must be completed and submitted, with material indicating content, to the Comptroller’s Property Tax

Assistance Division a minimum of 30 calendar days prior to the date of the continuing education program.

Continuing education programs must deal with one or more of the following qualifying topics:

(check all that apply)

For Comptroller Use Only:

______

______

Appraisal Standards and Methodology

CEs requested

CEs approved

______

______

Laws and Rules

CEs requested

CEs approved

______

______

Tax Assessment and Collection Practices

CEs requested

CEs approved

______

______

Ethics

CEs requested

CEs approved

______

______

Customer Service

CEs requested

CEs approved

______

______

Uniform Standards of Professional Appraisal Practice

CEs requested

CEs approved

______

______

State-Required Laws and Rules Update

CEs requested

CEs approved

__________________________________________________________________________________

________________________

Provider Contact Information

Date Submitted

For Comptroller Use Only:

Return original and attached

documentation to:

COMPTROLLER OF PUBLIC ACCOUNTS

__________________________________________________

_________________________

Property Tax Assistance Division

Continuing Education Staff

Date

P.O. Box 13528

Austin, Texas 78711-3528

___________________________________

APPROVED

, Continuing Education Credits Approved (total)

Fax (512) 305-9801

ptad.cpa@cpa.state.tx.us

DISAPPROVED

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-769 • 06-11/4

1

1