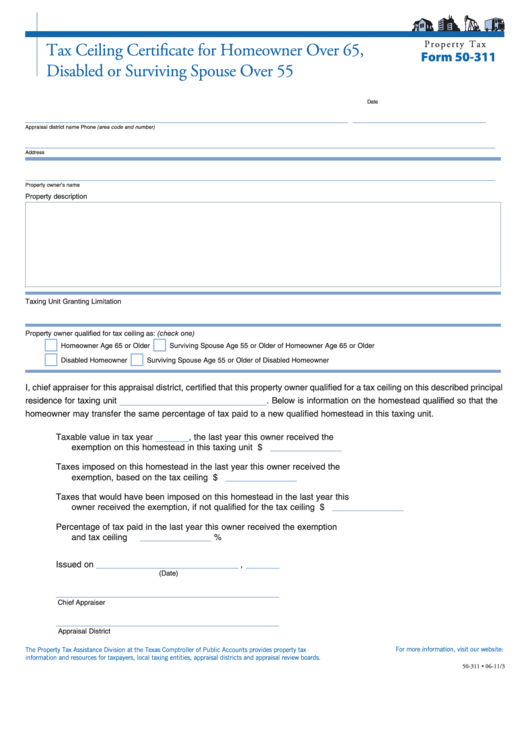

P r o p e r t y T a x

Tax Ceiling Certificate for Homeowner Over 65,

Form 50-311

Disabled or Surviving Spouse Over 55

____________________________

Date

____________________________________________________________________

____________________________

Appraisal district name

Phone (area code and number)

___________________________________________________________________________________________________

Address

___________________________________________________________________________________________________

Property owner’s name

Property description

Taxing Unit Granting Limitation

Property owner qualified for tax ceiling as: (check one)

Homeowner Age 65 or Older

Surviving Spouse Age 55 or Older of Homeowner Age 65 or Older

Disabled Homeowner

Surviving Spouse Age 55 or Older of Disabled Homeowner

I, chief appraiser for this appraisal district, certified that this property owner qualified for a tax ceiling on this described principal

residence for taxing unit

. Below is information on the homestead qualified so that the

_______________________________

homeowner may transfer the same percentage of tax paid to a new qualified homestead in this taxing unit.

Taxable value in tax year

, the last year this owner received the

_______

exemption on this homestead in this taxing unit . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_______________

Taxes imposed on this homestead in the last year this owner received the

exemption, based on the tax ceiling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_______________

Taxes that would have been imposed on this homestead in the last year this

owner received the exemption, if not qualified for the tax ceiling . . . . . . . . . . . . .

$

_______________

Percentage of tax paid in the last year this owner received the exemption

and tax ceiling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________

%

Issued on

______________________________

,

_______

(Date)

_______________________________________________

Chief Appraiser

_______________________________________________

Appraisal District

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-311 • 06-11/3

1

1