Comptroller

50-280

T

E

of Public

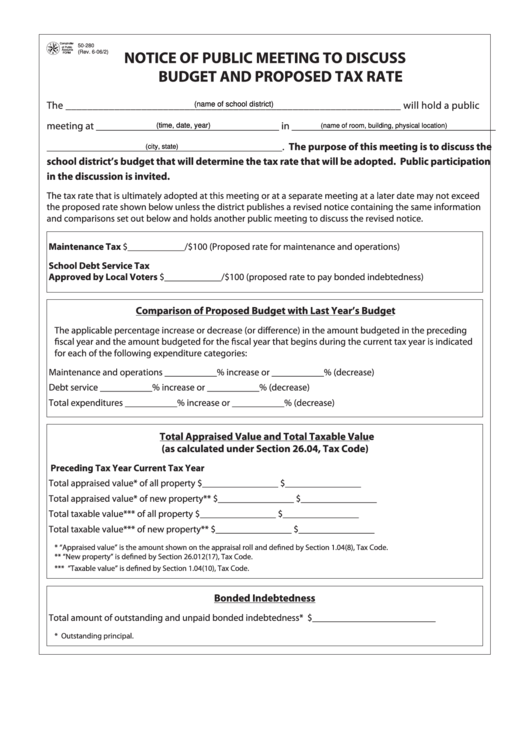

NOTICE OF PUBLIC MEETING TO DISCUSS

S

X

Accounts

(Rev. 6-06/2)

A

FORM

BUDGET AND PROPOSED TAX RATE

The ______________________________________________________________ will hold a public

(name of school district)

meeting at ___________________________________ in _______________________________________

(time, date, year)

(name of room, building, physical location)

_____________________________________________. The purpose of this meeting is to discuss the

(city, state)

school district’s budget that will determine the tax rate that will be adopted. Public participation

in the discussion is invited.

The tax rate that is ultimately adopted at this meeting or at a separate meeting at a later date may not exceed

the proposed rate shown below unless the district publishes a revised notice containing the same information

and comparisons set out below and holds another public meeting to discuss the revised notice.

Maintenance Tax

$____________/$100 (Proposed rate for maintenance and operations)

School Debt Service Tax

Approved by Local Voters $____________/$100 (proposed rate to pay bonded indebtedness)

Comparison of Proposed Budget with Last Year’s Budget

The applicable percentage increase or decrease (or difference) in the amount budgeted in the preceding

fiscal year and the amount budgeted for the fiscal year that begins during the current tax year is indicated

for each of the following expenditure categories:

Maintenance and operations ___________% increase

or

___________% (decrease)

Debt service

___________% increase

or

___________% (decrease)

Total expenditures

___________% increase

or

___________% (decrease)

Total Appraised Value and Total Taxable Value

(as calculated under Section 26.04, Tax Code)

Preceding Tax Year

Current Tax Year

Total appraised value* of all property

$________________

$________________

Total appraised value* of new property**

$________________

$________________

Total taxable value*** of all property

$________________

$________________

Total taxable value*** of new property**

$________________

$________________

*

“Appraised value” is the amount shown on the appraisal roll and defined by Section 1.04(8), Tax Code.

** “New property” is defined by Section 26.012(17), Tax Code.

*** “Taxable value” is defined by Section 1.04(10), Tax Code.

Bonded Indebtedness

Total amount of outstanding and unpaid bonded indebtedness* $__________________________

* Outstanding principal.

1

1 2

2