Form 50-231 - Notice Of Hearing

Download a blank fillable Form 50-231 - Notice Of Hearing in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 50-231 - Notice Of Hearing with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

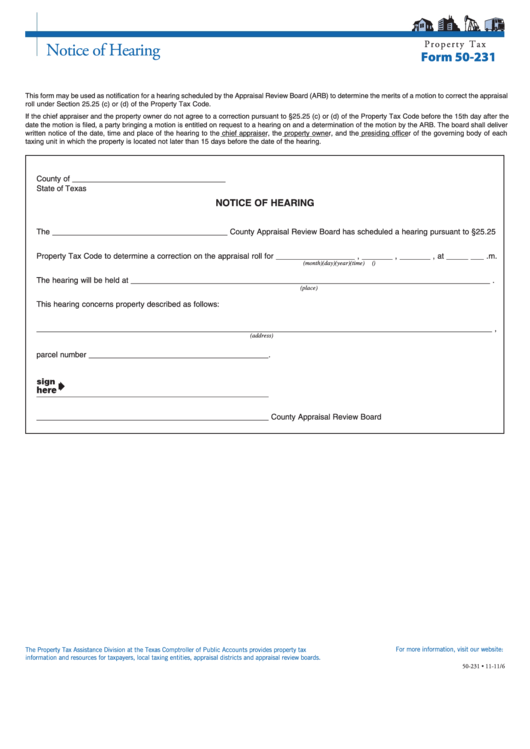

P r o p e r t y T a x

Notice of Hearing

Form 50-231

This form may be used as notification for a hearing scheduled by the Appraisal Review Board (ARB) to determine the merits of a motion to correct the appraisal

roll under Section 25.25 (c) or (d) of the Property Tax Code.

If the chief appraiser and the property owner do not agree to a correction pursuant to §25.25 (c) or (d) of the Property Tax Code before the 15th day after the

date the motion is filed, a party bringing a motion is entitled on request to a hearing on and a determination of the motion by the ARB. The board shall deliver

written notice of the date, time and place of the hearing to the chief appraiser, the property owner, and the presiding officer of the governing body of each

taxing unit in which the property is located not later than 15 days before the date of the hearing.

County of ___________________________________

State of Texas

NOTICE OF HEARING

The ________________________________________ County Appraisal Review Board has scheduled a hearing pursuant to §25.25

Property Tax Code to determine a correction on the appraisal roll for __________________ , _______ , _______ , at _____ ___ .m.

(month)

(day)

(year)

(time)

(a.m./p.m.)

The hearing will be held at __________________________________________________________________________________ .

(place)

This hearing concerns property described as follows:

________________________________________________________________________________________________________ ,

(address)

parcel number _________________________________________.

_____________________________________________________

_____________________________________________________ County Appraisal Review Board

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-231 • 11-11/6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1