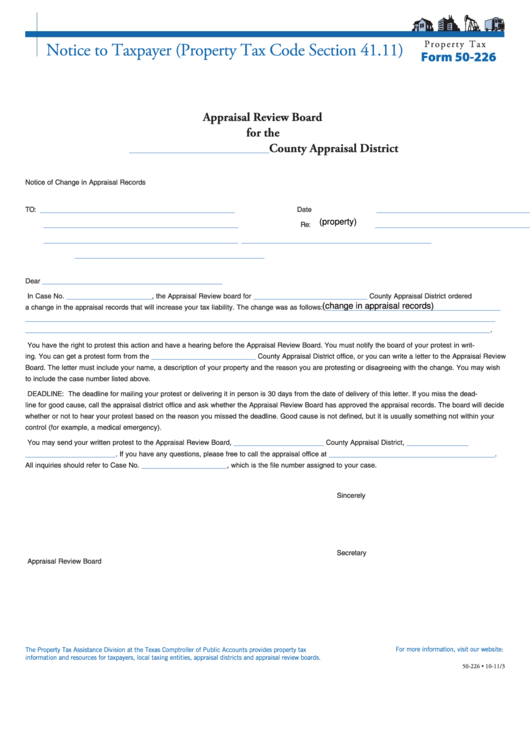

P r o p e r t y T a x

Notice to Taxpayer (Property Tax Code Section 41.11)

Form 50-226

Appraisal Review Board

for the

County Appraisal District

________________________________

Notice of Change in Appraisal Records

_________________________________________

_____________________________________

TO:

Date

(property)

_________________________________________

______________________________________

Re:

_________________________________________

________________________________________

________________________________________

______________________________________

Dear

__________________

________________________

In Case No.

, the Appraisal Review board for

County Appraisal District ordered

_____________________________________

(change in appraisal records)

a change in the appraisal records that will increase your tax liability. The change was as follows:

___________________________________________________________________________________________________

__________________________________________________________________________________________________

.

You have the right to protest this action and have a hearing before the Appraisal Review Board. You must notify the board of your protest in writ-

______________________

ing. You can get a protest form from the

County Appraisal District office, or you can write a letter to the Appraisal Review

Board. The letter must include your name, a description of your property and the reason you are protesting or disagreeing with the change. You may wish

to include the case number listed above.

DEADLINE: The deadline for mailing your protest or delivering it in person is 30 days from the date of delivery of this letter. If you miss the dead-

line for good cause, call the appraisal district office and ask whether the Appraisal Review Board has approved the appraisal records. The board will decide

whether or not to hear your protest based on the reason you missed the deadline. Good cause is not defined, but it is usually something not within your

control (for example, a medical emergency).

___________________

_____________

You may send your written protest to the Appraisal Review Board,

County Appraisal District,

___________________

___________________________________

. If you have any questions, please free to call the appraisal office at

.

__________________

All inquiries should refer to Case No.

, which is the file number assigned to your case.

Sincerely

Secretary

Appraisal Review Board

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-226 • 10-11/3

1

1