50-198 (10-11/08)

[41.41,41.70]

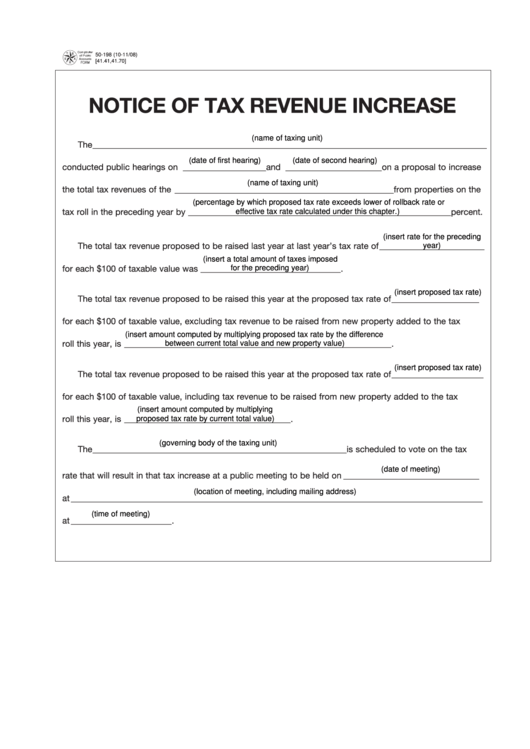

NOTICE OF TAX REVENUE INCREASE

(name of taxing unit)

The __________________________________________________________________________________________

(date of first hearing)

(date of second hearing)

conducted public hearings on ___________________ and ______________________on a proposal to increase

(name of taxing unit)

the total tax revenues of the __________________________________________________ from properties on the

(percentage by which proposed tax rate exceeds lower of rollback rate or

tax roll in the preceding year by ____________________________________________________________ percent.

effective tax rate calculated under this chapter.)

(insert rate for the preceding

The total tax revenue proposed to be raised last year at last year’s tax rate of ________________________

year)

(insert a total amount of taxes imposed

for each $100 of taxable value was ________________________________ .

for the preceding year)

(insert proposed tax rate)

The total tax revenue proposed to be raised this year at the proposed tax rate of ____________________

for each $100 of taxable value, excluding tax revenue to be raised from new property added to the tax

(insert amount computed by multiplying proposed tax rate by the difference

roll this year, is _____________________________________________________________.

between current total value and new property value)

(insert proposed tax rate)

The total tax revenue proposed to be raised this year at the proposed tax rate of _____________________

for each $100 of taxable value, including tax revenue to be raised from new property added to the tax

(insert amount computed by multiplying

roll this year, is ______________________________________ .

proposed tax rate by current total value)

(governing body of the taxing unit)

The __________________________________________________________ is scheduled to vote on the tax

(date of meeting)

rate that will result in that tax increase at a public meeting to be held on _______________________________

(location of meeting, including mailing address)

at ______________________________________________________________________________________________

(time of meeting)

at _______________________ .

1

1