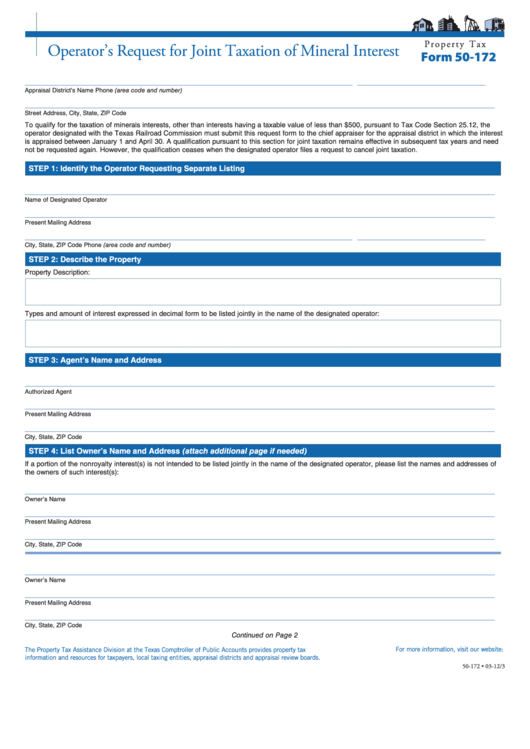

P r o p e r t y T a x

Operator’s Request for Joint Taxation of Mineral Interest

Form 50-172

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Street Address, City, State, ZIP Code

To qualify for the taxation of minerals interests, other than interests having a taxable value of less than $500, pursuant to Tax Code Section 25.12, the

operator designated with the Texas Railroad Commission must submit this request form to the chief appraiser for the appraisal district in which the interest

is appraised between January 1 and April 30. A qualification pursuant to this section for joint taxation remains effective in subsequent tax years and need

not be requested again. However, the qualification ceases when the designated operator files a request to cancel joint taxation.

STEP 1: Identify the Operator Requesting Separate Listing

___________________________________________________________________________________________________

Name of Designated Operator

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

STEP 2: Describe the Property

Property Description:

Types and amount of interest expressed in decimal form to be listed jointly in the name of the designated operator:

STEP 3: Agent’s Name and Address

___________________________________________________________________________________________________

Authorized Agent

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

STEP 4: List Owner’s Name and Address (attach additional page if needed)

If a portion of the nonroyalty interest(s) is not intended to be listed jointly in the name of the designated operator, please list the names and addresses of

the owners of such interest(s):

___________________________________________________________________________________________________

Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

___________________________________________________________________________________________________

Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

Continued on Page 2

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-172 • 03-12/3

1

1 2

2