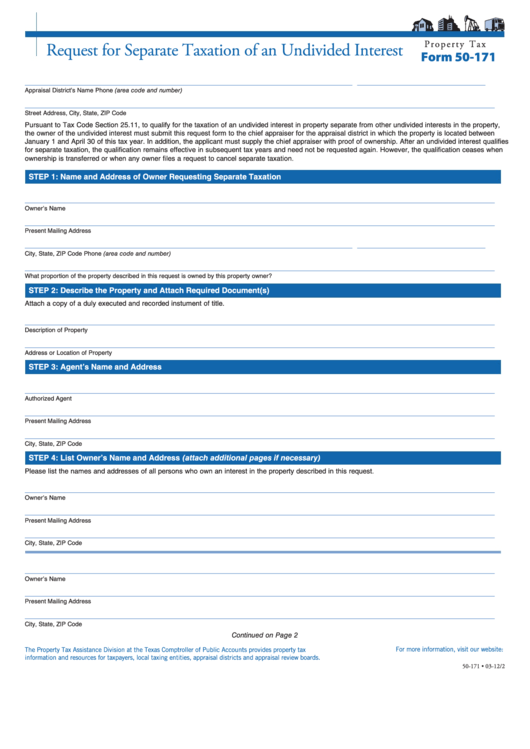

P r o p e r t y T a x

Request for Separate Taxation of an Undivided Interest

Form 50-171

_____________________________________________________________________

___________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Street Address, City, State, ZIP Code

Pursuant to Tax Code Section 25.11, to qualify for the taxation of an undivided interest in property separate from other undivided interests in the property,

the owner of the undivided interest must submit this request form to the chief appraiser for the appraisal district in which the property is located between

January 1 and April 30 of this tax year. In addition, the applicant must supply the chief appraiser with proof of ownership. After an undivided interest qualifies

for separate taxation, the qualification remains effective in subsequent tax years and need not be requested again. However, the qualification ceases when

ownership is transferred or when any owner files a request to cancel separate taxation.

STEP 1: Name and Address of Owner Requesting Separate Taxation

___________________________________________________________________________________________________

Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

___________________________________________________________________________________________________

What proportion of the property described in this request is owned by this property owner?

STEP 2: Describe the Property and Attach Required Document(s)

Attach a copy of a duly executed and recorded instument of title.

___________________________________________________________________________________________________

Description of Property

___________________________________________________________________________________________________

Address or Location of Property

STEP 3: Agent’s Name and Address

___________________________________________________________________________________________________

Authorized Agent

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

STEP 4: List Owner’s Name and Address (attach additional pages if necessary)

Please list the names and addresses of all persons who own an interest in the property described in this request.

___________________________________________________________________________________________________

Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

___________________________________________________________________________________________________

Owner’s Name

___________________________________________________________________________________________________

Present Mailing Address

___________________________________________________________________________________________________

City, State, ZIP Code

Continued on Page 2

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-171 • 03-12/2

1

1 2

2