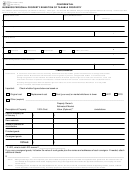

P r o p e r t y T a x

B u s i n e s s P e r s o n a l P r o p e r t y R e n d i t i o n o f T a x a b l e P r o p e r t y

Form 50-144

Definitions

Personal Property: Every kind of property that is not real

Good Faith Estimate of Market Value: Your best estimate

property; generally, property that is movable without dam-

of what the property would have sold for in U.S. dollars on

age to itself or the associated real property.

January 1 of the current tax year if it had been on the mar-

ket for a reasonable length of time and neither you nor the

purchaser was forced to buy or sell. For inventory, it is the

Inventory: Personal property that is held for sale to the

price for which the property would have sold as a unit to a

public by a commercial enterprise.

purchaser who would continue the business.

Type/Category: Functionally similar personal property

Historical Cost When New: What you paid for the property

groups. Examples are: furniture, fixtures, machinery, equip-

when it was new, or if you bought the property used, what

ment, vehicles, and supplies. Narrower groupings such as

the original buyer paid when it was new. If you bought the

personal computers, milling equipment, freezer cases, and

property used, and do not know what the original buyer paid,

forklifts should be used, if possible. A person is not required

state what you paid with a note that you purchased it used.

to render for taxation personal property appraised under

section 23.24.

Year Acquired: The year that you purchased the property.

Estimate of Quantity: For each type or category listed, the

number of items, or other relevant measure of quantity (e.g.,

Consigned Goods: Personal property owned by another

gallons, bushels, tons, pounds, board feet).

person that you are selling by arrangement with that person.

If you have consigned goods, report the name and address

of the owner in the appropriate blank.

Property Address: The physical address of the personal

property on January 1 of the current tax year. Normally, the

property is taxable by the taxing unit where the property is

Fiduciary: A person or institution who manages property for

located.

another and who must exercise a standard of care in such

management activity imposed by law or contract.

Address Where Taxable: In some instances, personal

property that is only temporarily at its current address may

be taxable at another location (taxable situs). If you know

that this is the case, please list the address where taxable.

For more information, visit our website:

50-144 • 03-12/10 • Page 3

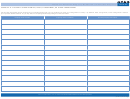

1

1 2

2 3

3 4

4 5

5 6

6 7

7