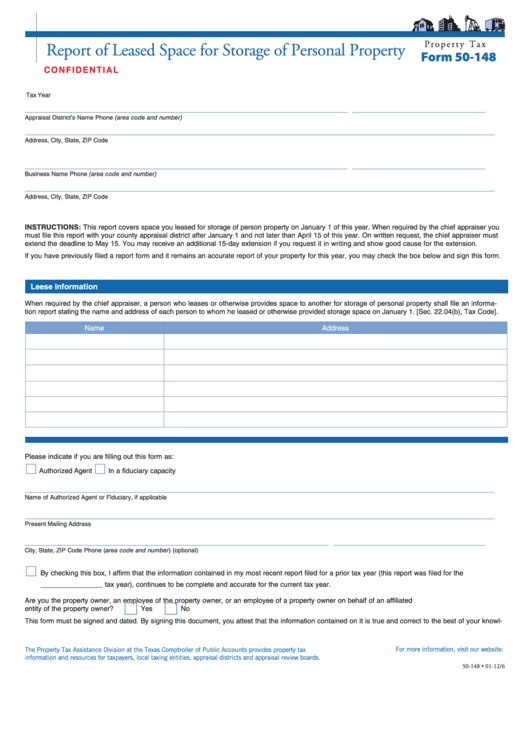

P r o p e r t y T a x

Report of Leased Space for Storage of Personal Property

Form 50-148

C O N F I D E N T I A L

____________________________

Tax Year

____________________________________________________________________

____________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

____________________________________________________________________

____________________________

Business Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

INSTRUCTIONS: This report covers space you leased for storage of person property on January 1 of this year. When required by the chief appraiser you

must file this report with your county appraisal district after January 1 and not later than April 15 of this year. On written request, the chief appraiser must

extend the deadline to May 15. You may receive an additional 15-day extension if you request it in writing and show good cause for the extension.

If you have previously filed a report form and it remains an accurate report of your property for this year, you may check the box below and sign this form.

Leese Information

When required by the chief appraiser, a person who leases or otherwise provides space to another for storage of personal property shall file an informa-

tion report stating the name and address of each person to whom he leased or otherwise provided storage space on January 1. [Sec. 22.04(b), Tax Code].

Name

Address

Please indicate if you are filling out this form as:

Authorized Agent

In a fiduciary capacity

___________________________________________________________________________________________________

Name of Authorized Agent or Fiduciary, if applicable

___________________________________________________________________________________________________

Present Mailing Address

________________________________________________________________

________________________________

City, State, ZIP Code

Phone (area code and number) (optional)

By checking this box, I affirm that the information contained in my most recent report filed for a prior tax year (this report was filed for the

________________ tax year), continues to be complete and accurate for the current tax year.

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated

entity of the property owner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of your knowl-

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-148 • 01-12/6

1

1 2

2