880

IR

July 2017

Paid parental leave (PPL) application

What is paid parental leave?

Paid parental leave is a government-funded entitlement paid to eligible parents and other primary carers when they take parental leave or

stop working. These payments generally cover the first 18 weeks after a new baby is born or a child under the age of six arrives in their care.

PPL goes towards the loss of income that primary carers experience when they stop working to care for this new baby or child.

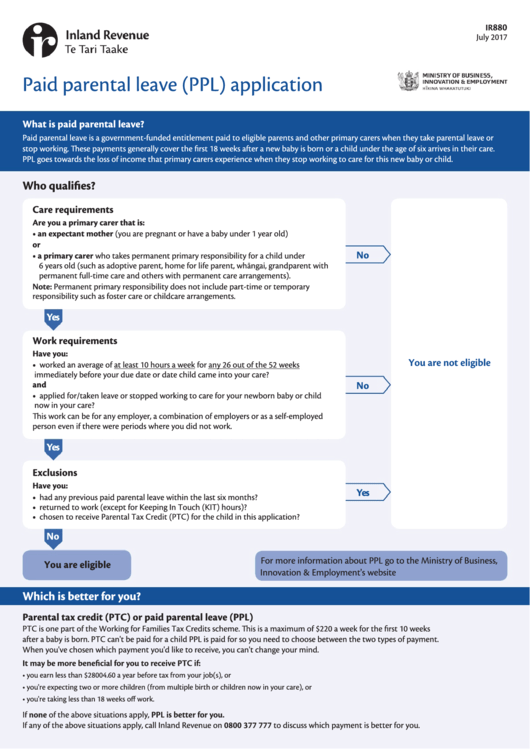

Who qualifies?

Care requirements

Are you a primary carer that is:

• an expectant mother (you are pregnant or have a baby under 1 year old)

or

No

• a primary carer who takes permanent primary responsibility for a child under

6 years old (such as adoptive parent, home for life parent, whāngai, grandparent with

permanent full-time care and others with permanent care arrangements).

Note: Permanent primary responsibility does not include part-time or temporary

responsibility such as foster care or childcare arrangements.

Yes

Work requirements

Have you:

You are not eligible

• worked an average of at least 10 hours a week for any 26 out of the 52 weeks

immediately before your due date or date child came into your care?

and

No

• applied for/taken leave or stopped working to care for your newborn baby or child

now in your care?

This work can be for any employer, a combination of employers or as a self-employed

person even if there were periods where you did not work.

Yes

Exclusions

Have you:

Yes

• had any previous paid parental leave within the last six months?

• returned to work (except for Keeping In Touch (KIT) hours)?

• chosen to receive Parental Tax Credit (PTC) for the child in this application?

No

For more information about PPL go to the Ministry of Business,

You are eligible

Innovation & Employment's website

Which is better for you?

Parental tax credit (PTC) or paid parental leave (PPL)

PTC is one part of the Working for Families Tax Credits scheme. This is a maximum of $220 a week for the first 10 weeks

after a baby is born. PTC can't be paid for a child PPL is paid for so you need to choose between the two types of payment.

When you've chosen which payment you'd like to receive, you can't change your mind.

It may be more beneficial for you to receive PTC if:

• you earn less than $28004.60 a year before tax from your job(s), or

• you're expecting two or more children (from multiple birth or children now in your care), or

• you're taking less than 18 weeks off work.

If none of the above situations apply, PPL is better for you.

If any of the above situations apply, call Inland Revenue on 0800 377 777 to discuss which payment is better for you.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8