Form Ct-1120sf - Service Facility Tax Credit - Connecticut Department Of Revenue - 2014

ADVERTISEMENT

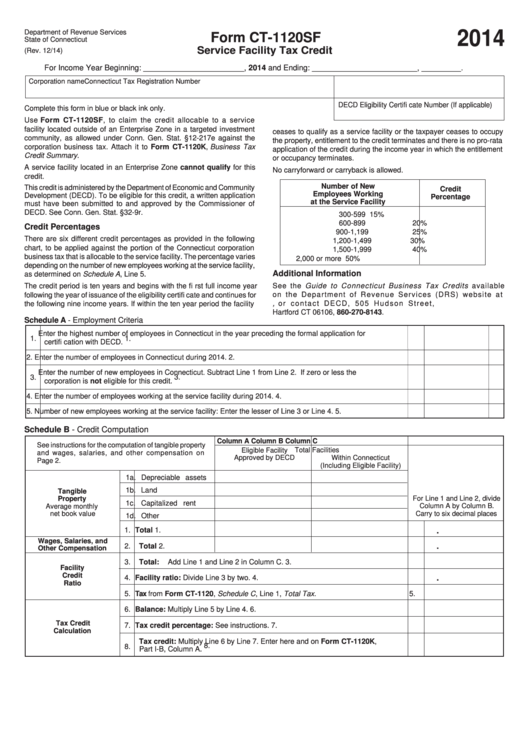

Department of Revenue Services

2014

Form CT-1120SF

State of Connecticut

Service Facility Tax Credit

(Rev. 12/14)

For Income Year Beginning: _______________________ , 2014 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

DECD Eligibility Certifi cate Number (If applicable)

Complete this form in blue or black ink only.

Use Form CT-1120SF, to claim the credit allocable to a service

facility located outside of an Enterprise Zone in a targeted investment

ceases to qualify as a service facility or the taxpayer ceases to occupy

community, as allowed under Conn. Gen. Stat. §12-217e against the

the property, entitlement to the credit terminates and there is no pro-rata

corporation business tax. Attach it to Form CT-1120K, Business Tax

application of the credit during the income year in which the entitlement

Credit Summary.

or occupancy terminates.

A service facility located in an Enterprise Zone cannot qualify for this

No carryforward or carryback is allowed.

credit.

Number of New

This credit is administered by the Department of Economic and Community

Credit

Employees Working

Development (DECD). To be eligible for this credit, a written application

Percentage

at the Service Facility

must have been submitted to and approved by the Commissioner of

DECD. See Conn. Gen. Stat. §32-9r.

300-599

15%

600-899

20%

Credit Percentages

900-1,199

25%

There are six different credit percentages as provided in the following

1,200-1,499

30%

chart, to be applied against the portion of the Connecticut corporation

1,500-1,999

40%

business tax that is allocable to the service facility. The percentage varies

2,000 or more

50%

depending on the number of new employees working at the service facility,

Additional Information

as determined on Schedule A, Line 5.

The credit period is ten years and begins with the fi rst full income year

See the Guide to Connecticut Business Tax Credits available

on the Department of Revenue Services (DRS) website at

following the year of issuance of the eligibility certifi cate and continues for

w w w. c t . g o v / d r s , o r c o n t a c t D E C D , 5 0 5 H u d s o n S t r e e t ,

the following nine income years. If within the ten year period the facility

Hartford CT 06106, 860-270-8143.

Schedule A - Employment Criteria

Enter the highest number of employees in Connecticut in the year preceding the formal application for

1.

1.

certifi cation with DECD.

2. Enter the number of employees in Connecticut during 2014.

2.

Enter the number of new employees in Connecticut. Subtract Line 1 from Line 2. If zero or less the

3.

3.

corporation is not eligible for this credit.

4. Enter the number of employees working at the service facility during 2014.

4.

5. Number of new employees working at the service facility: Enter the lesser of Line 3 or Line 4.

5.

Schedule B - Credit Computation

Column A

Column B

Column C

See instructions for the computation of tangible property

Eligible Facility

Total Facilities

and wages, salaries, and other compensation on

Approved by DECD

Within Connecticut

Page 2.

(Including Eligible Facility)

1a. Depreciable assets

1b. Land

Tangible

For Line 1 and Line 2, divide

Property

1c. Capitalized rent

Average monthly

Column A by Column B.

net book value

Carry to six decimal places

1d. Other

1.

Total

1.

.

Wages, Salaries, and

.

2.

Total

2.

Other Compensation

3.

Total: Add Line 1 and Line 2 in Column C.

3.

Facility

Credit

.

4.

Facility ratio: Divide Line 3 by two.

4.

Ratio

5.

Tax from Form CT-1120, Schedule C, Line 1, Total Tax.

5.

6.

Balance: Multiply Line 5 by Line 4.

6.

Tax Credit

7.

Tax credit percentage: See instructions.

7.

Calculation

Tax credit: Multiply Line 6 by Line 7. Enter here and on Form CT-1120K,

8.

8.

Part I-B, Column A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2