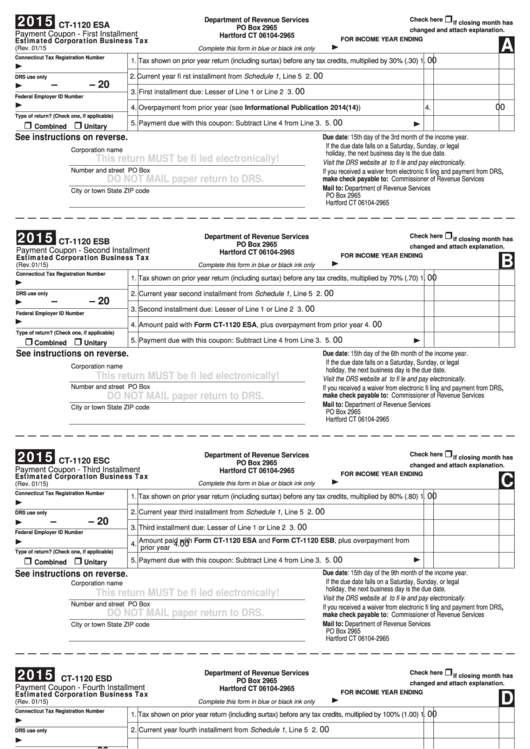

Form Ct-1120es - Estimate Corporation Business Tax - Connecticut Department Of Revenue - 2015

ADVERTISEMENT

2015

Department of Revenue Services

Check here

if closing month has

CT-1120 ESA

PO Box 2965

changed and attach explanation.

Payment Coupon - First Installment

Hartford CT 06104-2965

Estimated Corporation Business Tax

FOR INCOME YEAR ENDING

A

(Rev. 01/15

Complete this form in blue or black ink only

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 30% (.30)

1.

00

2. Current year fi rst installment from Schedule 1, Line 5

2.

DRS use only

–

– 20

00

3. First installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

00

4. Overpayment from prior year (see Informational Publication 2014(14))

4.

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 3rd month of the income year.

If the due date falls on a Saturday, Sunday, or legal

Corporation name

holiday, the next business day is the due date.

This return MUST be fi led electronically!

Visit the DRS website at to fi le and pay electronically.

Number and street

PO Box

If you received a waiver from electronic fi ling and payment from DRS,

DO NOT MAIL paper return to DRS.

make check payable to: Commissioner of Revenue Services

Mail to:

Department of Revenue Services

City or town

State

ZIP code

PO Box 2965

Hartford CT 06104-2965

2015

Department of Revenue Services

Check here

if closing month has

CT-1120 ESB

PO Box 2965

changed and attach explanation.

Payment Coupon - Second Installment

Hartford CT 06104-2965

Estimated Corporation Business Tax

FOR INCOME YEAR ENDING

B

(Rev. 01/15)

Complete this form in blue or black ink only

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 70% (.70)

1.

00

2. Current year second installment from Schedule 1, Line 5

2.

DRS use only

–

– 20

00

3. Second installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

00

4. Amount paid with Form CT-1120 ESA, plus overpayment from prior year

4.

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 6th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

Corporation name

holiday, the next business day is the due date.

This return MUST be fi led electronically!

Visit the DRS website at to fi le and pay electronically.

Number and street

PO Box

If you received a waiver from electronic fi ling and payment from DRS,

DO NOT MAIL paper return to DRS.

make check payable to: Commissioner of Revenue Services

Mail to:

Department of Revenue Services

City or town

State

ZIP code

PO Box 2965

Hartford CT 06104-2965

2015

Department of Revenue Services

Check here

if closing month has

CT-1120 ESC

PO Box 2965

changed and attach explanation.

Payment Coupon - Third Installment

Hartford CT 06104-2965

Estimated Corporation Business Tax

FOR INCOME YEAR ENDING

C

(Rev. 01/15)

Complete this form in blue or black ink only

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 80% (.80)

1.

00

2. Current year third installment from Schedule 1, Line 5

2.

DRS use only

–

– 20

00

3. Third installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

Amount paid with Form CT-1120 ESA and Form CT-1120 ESB, plus overpayment from

00

4.

4.

prior year

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 9th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

Corporation name

holiday, the next business day is the due date.

This return MUST be fi led electronically!

Visit the DRS website at to fi le and pay electronically.

Number and street

PO Box

If you received a waiver from electronic fi ling and payment from DRS,

DO NOT MAIL paper return to DRS.

make check payable to: Commissioner of Revenue Services

Mail to:

Department of Revenue Services

City or town

State

ZIP code

PO Box 2965

Hartford CT 06104-2965

2015

Department of Revenue Services

Check here

if closing month has

CT-1120 ESD

PO Box 2965

changed and attach explanation.

Payment Coupon - Fourth Installment

Hartford CT 06104-2965

Estimated Corporation Business Tax

FOR INCOME YEAR ENDING

D

(Rev. 01/15)

Complete this form in blue or black ink only

Connecticut Tax Registration Number

00

1. Tax shown on prior year return (including surtax) before any tax credits, multiplied by 100% (1.00)

1.

00

2. Current year fourth installment from Schedule 1, Line 5

2.

DRS use only

–

– 20

00

3. Fourth installment due: Lesser of Line 1 or Line 2

3.

Federal Employer ID Number

4. Amount paid with Form CT-1120 ESA, Form CT-1120 ESB, and Form CT-1120 ESC,

00

4.

plus overpayment from prior year

Type of return? (Check one, if applicable)

00

5. Payment due with this coupon: Subtract Line 4 from Line 3.

5.

Combined

Unitary

See instructions on reverse.

Due date:

15th day of the 12th month of the income year.

If the due date falls on a Saturday, Sunday, or legal

Corporation name

holiday, the next business day is the due date.

This return MUST be fi led electronically!

Visit the DRS website at to fi le and pay electronically.

Number and street

PO Box

If you received a waiver from electronic fi ling and payment from DRS,

DO NOT MAIL paper return to DRS.

make check payable to: Commissioner of Revenue Services

Mail to:

Department of Revenue Services

City or town

State

ZIP code

PO Box 2965

Hartford CT 06104-2965

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2