Form 92a300 - Affidavit Of Exemption

ADVERTISEMENT

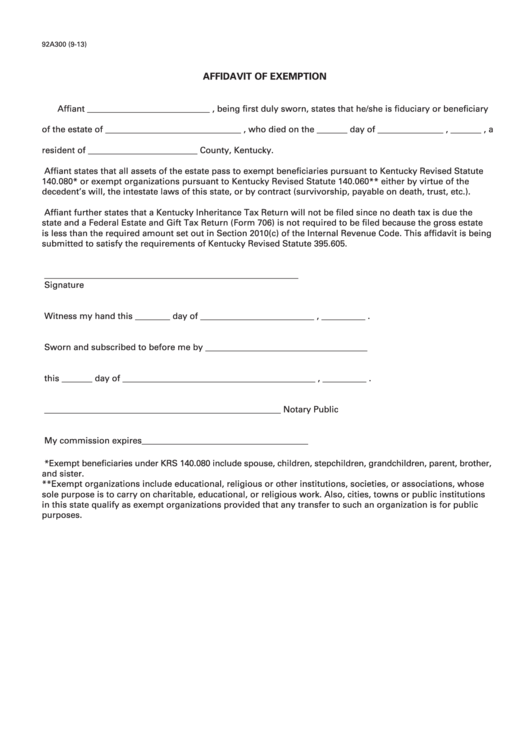

92A300 (9-13)

AFFIDAVIT OF EXEMPTION

Affiant ____________________________ , being first duly sworn, states that he/she is fiduciary or beneficiary

of the estate of _______________________________ , who died on the _______ day of _______________ , _______ , a

resident of _________________________ County, Kentucky.

Affiant states that all assets of the estate pass to exempt beneficiaries pursuant to Kentucky Revised Statute

140.080* or exempt organizations pursuant to Kentucky Revised Statute 140.060** either by virtue of the

decedent’s will, the intestate laws of this state, or by contract (survivorship, payable on death, trust, etc.).

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the

state and a Federal Estate and Gift Tax Return (Form 706) is not required to be filed because the gross estate

is less than the required amount set out in Section 2010(c) of the Internal Revenue Code. This affidavit is being

submitted to satisfy the requirements of Kentucky Revised Statute 395.605.

__________________________________________________________

Signature

Witness my hand this ________ day of __________________________ , __________ .

Sworn and subscribed to before me by _____________________________________

this _______ day of ____________________________________________ , __________ .

______________________________________________________ Notary Public

My commission expires______________________________________

*Exempt beneficiaries under KRS 140.080 include spouse, children, stepchildren, grandchildren, parent, brother,

and sister.

**Exempt organizations include educational, religious or other institutions, societies, or associations, whose

sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions

in this state qualify as exempt organizations provided that any transfer to such an organization is for public

purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1