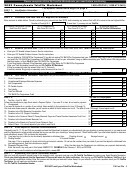

PA-40 W-2 RW (04-06)

W-2 Reconciliation Worksheet

PA-40 W-2 RW (04-06)

OVERVIEW

Use the PA-40 W-2 RW in situations where: 1) Federal Form W-2 information is incomplete for determining the correct amount of Pennsylvania taxable

compensation, 2) Medicare wages are different from Pennsylvania wages and insufficient W-2 coding is present to explain the differences, or 3) to show

amounts of any previously taxed Non-Qualified Deferred Compensation. Examples include instances where the employer fails to show on the W-2 the

amount of S corporation owner health benefits or personal use of company auto included in Federal and Medicare wages that are not included in

Pennsylvania wages.

The W-2 RW is arranged in a three column format. The first column is used to reconcile your Federal wages to Medicare wages. The second column is

used to reconcile your Federal wages to Pennsylvania wages, and the third is to reconcile Medicare wages to Pennsylvania wages.

SPECIFIC INSTRUCTIONS

At the top of the form enter your Name and Social Security Number. Then complete the following:

PART I – STARTING POINT

: List each of the following amounts:

1) Federal Wages from Box 1 of the Form W-2 in Column A and Column B,

2) Medicare Wages from Box 5 of the Form W-2 in Column C.

PART II – ADDITIONS:

List the amounts for each of the following lines in the appropriate columns:

Line 1

Company contribution to deferred compensation plan.

Column A

Line 2

Elective deferrals to IRC § 401(K) - Code “D” in Box 12.

Columns A & B

Line 3

Elective deferrals under IRC § 403(b) salary reduction agreement - Code “E” in Box 12.

Columns A & B

Line 4

Elective deferrals under IRC § 408(k)(6) salary reduction agreement SEP - Code “F” in Box 12.

Columns A & B

Line 5

Elective & non-elective deferrals under IRC § 457(b) deferred compensation plan - Code

“G” in Box 12.

Columns A & B

Line 6

Elective deferrals to a § 501 (C)(18)(D) tax-exempt organization plan – Code “H” in Box 12.

Columns A & B

Line 7

Income under IRC § 409A nonqualified deferred compensation plan - Code “Z” in Box 12.

Column A

Line 8

Deferrals under IRC § 409A nonqualified deferred compensation plan - Code “Y” in Box 12.

Column A

Line 9

OTHER ADDITIONS: Include amounts for any items not shown on Lines 1 through 8 that are

Any appropriate column

taxable as Medicare or Pennsylvania wages that are not included in taxable Federal or

Medicare wages. (Provide full descriptions along with corresponding amounts.)

TOTAL PART II

-- Add Lines 1 through 9e for each column.

PART III – SUBTRACTIONS:

List the amounts for each of the following lines in the appropriate columns:

Line 10

Company contribution to deferred compensation plan.

Column C

Line 11

Cost of group-term life - Code “C” in Box 12.

Columns B & C

Line 12

Income under IRC § 409A nonqualified deferred compensation plan - Code “Z” in Box 12.

Column C

Line 13

Deferrals under IRC § 409A nonqualified deferred compensation plan - Code “Y” in Box 12.

Column C

Line 14

Personal use of company vehicle.

Columns B & C

Line 15

Distributions from an IRC § 409A nonqualified deferred compensation plan.

Column A

Line 16

Distributions from an IRC § 409A nonqualified deferred compensation plan previously taxed for

Pennsylvania purposes.

Column B

OTHER SUBTRACTIONS:

Line 17

Include amounts for any items not shown on Lines

Any appropriate column

10 through 16 that are not taxable for Pennsylvania or Medicare wages that are taxable as

Federal or Medicare wages. (Provide full descriptions along with corresponding amounts.)

TOTAL PART III

-- Add Lines 10 through 17e for each column.

PART IV – FINISHING POINT:

For each column, add the amount from Part I and the Total from Part II together and subtract the amount from the

Total for Part III.

The results should be the amounts reported on your W-2 for either Medicare or Pennsylvania Wages. If the amounts calculated don’t match the amounts

listed on the W-2 provided by your employer, you may be required to make adjustments to your Pennsylvania reportable compensation.

1

1 2

2