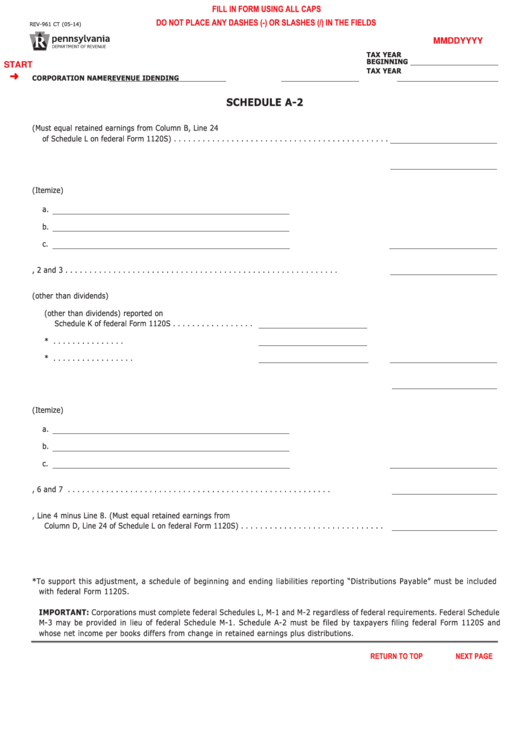

FILL IN FORM USING ALL CAPS

DO NOT PLACE ANY DASHES (-) OR SLASHES (/) IN THE FIELDS

REV-961 CT (05-14)

MMDDYYYY

TAX YEAR

BEGINNING

START

TAX YEAR

CORPORATION NAME

REVENUE ID

ENDING

SCHEDULE A-2

1. Beginning Retained Earnings (Must equal retained earnings from Column B, Line 24

of Schedule L on federal Form 1120S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Net Income per Books from Schedule M-1 or Schedule M-3 of federal Form 1120S . . . . . . . . . . . . .

3. Other Increases (Itemize)

a.

b.

c.

4. Add Lines 1, 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Distributions (other than dividends)

a. Distributions (other than dividends) reported on

Schedule K of federal Form 1120S . . . . . . . . . . . . . . . . .

b. Less Beginning Distributions Payable* . . . . . . . . . . . . . . .

c. Plus Ending Distributions Payable* . . . . . . . . . . . . . . . . .

6. Dividend distributions reported on Schedule K of federal Form 1120S . . . . . . . . . . . . . . . . . . . . . .

7. Other Decreases (Itemize)

a.

b.

c.

8. Total Lines 5, 6 and 7

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Ending Retained Earnings, Line 4 minus Line 8. (Must equal retained earnings from

Column D, Line 24 of Schedule L on federal Form 1120S) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

* To support this adjustment, a schedule of beginning and ending liabilities reporting “Distributions Payable” must be included

with federal Form 1120S.

IMPORTANT: Corporations must complete federal Schedules L, M-1 and M-2 regardless of federal requirements. Federal Schedule

M-3 may be provided in lieu of federal Schedule M-1. Schedule A-2 must be filed by taxpayers filing federal Form 1120S and

whose net income per books differs from change in retained earnings plus distributions.

PRINT FORM

Reset Entire Form

RETURN TO TOP

NEXT PAGE

1

1 2

2