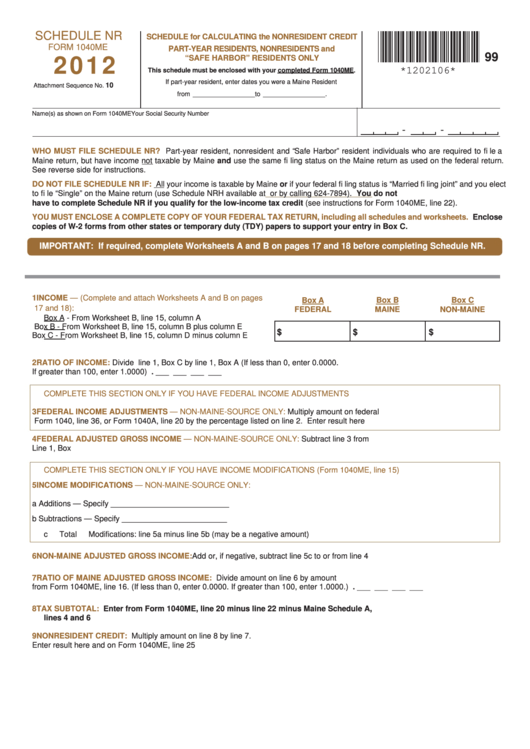

SCHEDULE NR

SCHEDULE for CALCULATING the NONRESIDENT CREDIT

FORM 1040ME

PART-YEAR RESIDENTS, NONRESIDENTS and

2012

99

“SAFE HARBOR” RESIDENTS ONLY

*1202106*

This schedule must be enclosed with your completed Form 1040ME.

If part-year resident, enter dates you were a Maine Resident

10

Attachment Sequence No.

from _________________ to _________________ .

Name(s) as shown on Form 1040ME

Your Social Security Number

-

-

WHO MUST FILE SCHEDULE NR?

Part-year resident, nonresident and “Safe Harbor” resident individuals who are required to fi le a

Maine return, but have income not taxable by Maine and use the same fi ling status on the Maine return as used on the federal return.

See reverse side for instructions.

DO NOT FILE SCHEDULE NR IF:

All your income is taxable by Maine or if your federal fi ling status is “Married fi ling joint” and you elect

to fi le “Single” on the Maine return (use Schedule NRH available at

or by calling 624-7894). You do not

have to complete Schedule NR if you qualify for the low-income tax credit (see instructions for Form 1040ME, line 22).

YOU MUST ENCLOSE A COMPLETE COPY OF YOUR FEDERAL TAX RETURN, including all schedules and worksheets.

Enclose

copies of W-2 forms from other states or temporary duty (TDY) papers to support your entry in Box C.

IMPORTANT: If required, complete Worksheets A and B on pages 17 and 18 before completing Schedule NR.

1 INCOME — (Complete and attach Worksheets A and B on pages

Box A

Box B

Box C

17 and 18):

FEDERAL

MAINE

NON-MAINE

Box A - From Worksheet B, line 15, column A

Box B - From Worksheet B, line 15, column B plus column E

$

$

$

Box C - From Worksheet B, line 15, column D minus column E .....

2 RATIO OF INCOME:

Divide line 1, Box C by line 1, Box A (If less than 0, enter 0.0000.

If greater than 100, enter 1.0000) ................................................................................................................. ___ . ___ ___ ___ ___

COMPLETE THIS SECTION ONLY IF YOU HAVE FEDERAL INCOME ADJUSTMENTS

3 FEDERAL INCOME ADJUSTMENTS — NON-MAINE-SOURCE ONLY:

Multiply amount on federal

Form 1040, line 36, or Form 1040A, line 20 by the percentage listed on line 2. Enter result here ..............

___________________

4 FEDERAL ADJUSTED GROSS INCOME — NON-MAINE-SOURCE ONLY:

Subtract line 3 from

Line 1, Box C.................................................................................................................................................

___________________

COMPLETE THIS SECTION ONLY IF YOU HAVE INCOME MODIFICATIONS (Form 1040ME, line 15)

5 INCOME MODIFICATIONS — NON-MAINE-SOURCE ONLY:

a Additions — Specify ___________________________ ................................. __________________

b Subtractions — Specify ________________________ ................................. __________________

c Total Modifi cations: line 5a minus line 5b (may be a negative amount)...................................................

___________________

6 NON-MAINE ADJUSTED GROSS INCOME:

Add or, if negative, subtract line 5c to or from line 4 ............

___________________

7 RATIO OF MAINE ADJUSTED GROSS INCOME:

Divide amount on line 6 by amount

from Form 1040ME, line 16. (If less than 0, enter 0.0000. If greater than 100, enter 1.0000.) ..................... ___ . ___ ___ ___ ___

8 TAX SUBTOTAL:

Enter from Form 1040ME, line 20 minus line 22 minus Maine Schedule A,

lines 4 and 6 ................................................................................................................................................

___________________

9 NONRESIDENT CREDIT:

Multiply amount on line 8 by line 7.

Enter result here and on Form 1040ME, line 25 ...........................................................................................

___________________

1

1 2

2