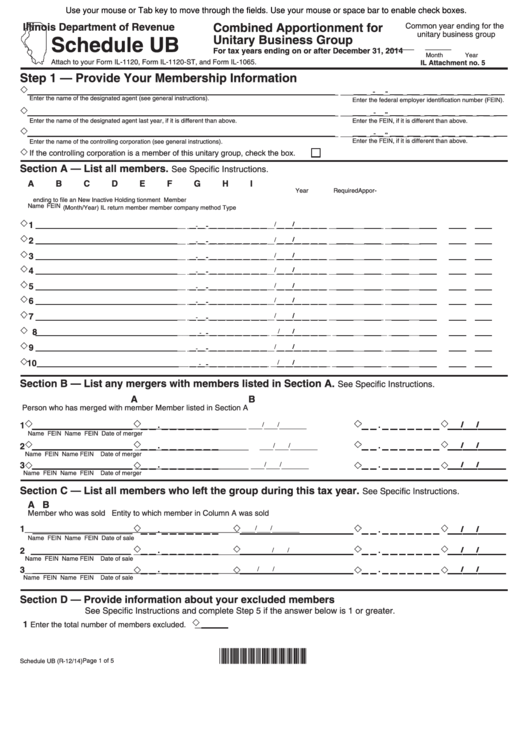

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Combined Apportionment for

Common year ending for the

unitary business group

Schedule UB

Unitary Business Group

______

______

For tax years ending on or after December 31, 2014

Month

Year

Attach to your Form IL-1120, Form IL-1120-ST, and Form IL-1065.

IL Attachment no. 5

Step 1 — Provide Your Membership Information

_______________________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Enter the name of the designated agent (see general instructions).

Enter the federal employer identification number (FEIN).

_______________________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Enter the name of the designated agent last year, if it is different than above.

Enter the FEIN, if it is different than above.

_______________________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Enter the name of the controlling corporation (see general instructions).

Enter the FEIN, if it is different than above.

If the controlling corporation is a member of this unitary group, check the box.

Section A — List all members.

See Specific Instructions.

A

B

C

D

E

F

G

H

I

Year

Required

Appor-

ending

to file an

New

Inactive

Holding

tionment Member

Name

FEIN

(Month/Year)

IL return member member company

method

Type

1

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

2

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

3

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

4

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

5

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

6

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

7

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

8

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

9

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

10

__ __ / __ __ __ __

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

Section B — List any mergers with members listed in Section A.

See Specific Instructions.

A

B

Person who has merged with member

Member listed in Section A

1

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of merger

2

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of merger

3

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of merger

Section C — List all members who left the group during this tax year.

See Specific Instructions.

A

B

Member who was sold

Entity to which member in Column A was sold

1

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of sale

2

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of sale

3

_______________________

__________________________

____ / ____ / ________

Name

FEIN

Name

FEIN

Date of sale

Section D — Provide information about your excluded members

See Specific Instructions and complete Step 5 if the answer below is 1 or greater.

1

Enter the total number of members excluded.

______

*433301110*

Page 1 of 5

Schedule UB (R-12/14)

1

1 2

2 3

3 4

4 5

5