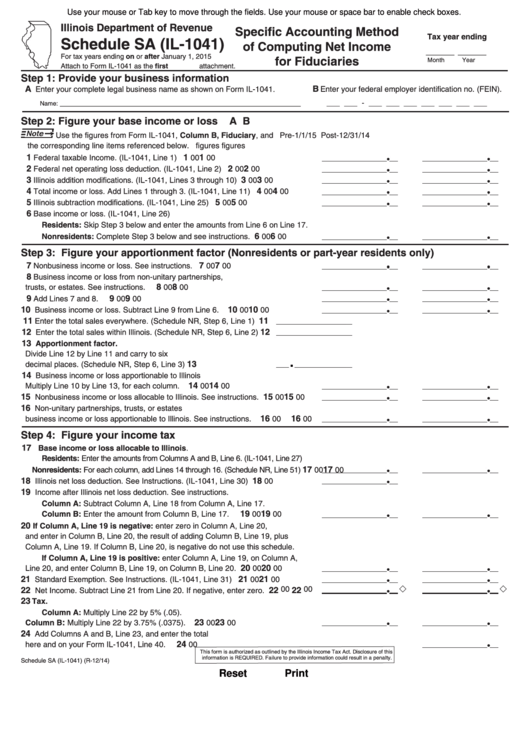

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Specific Accounting Method

Tax year ending

Schedule SA (IL-1041)

of Computing Net Income

______ ______

For tax years ending on or after January 1, 2015

for Fiduciaries

Month

Year

Attach to Form IL-1041 as the first attachment.

Step 1: Provide your business information

B

A

Enter your complete legal business name as shown on Form IL-1041.

Enter your federal employer identification no. (FEIN).

_______________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name:

Step 2: Figure your base income or loss

A

B

Use the figures from Form IL-1041, Column B, Fiduciary, and

Pre-1/1/15

Post-12/31/14

the corresponding line items referenced below.

figures

figures

1

1

1

Federal taxable Income. (IL-1041, Line 1)

00

00

2

2

2

00

00

Federal net operating loss deduction. (IL-1041, Line 2)

3

3

3

Illinois addition modifications. (IL-1041, Lines 3 through 10)

00

00

4

4

4

Total income or loss. Add Lines 1 through 3. (IL-1041, Line 11)

00

00

5

5

5

Illinois subtraction modifications. (IL-1041, Line 25)

00

00

6

Base income or loss. (IL-1041, Line 26)

Residents: Skip Step 3 below and enter the amounts from Line 6 on Line 17.

6

6

Nonresidents: Complete Step 3 below and see instructions.

00

00

Step 3: Figure your apportionment factor (Nonresidents or part-year residents only)

7

7

7

Nonbusiness income or loss. See instructions.

00

00

8

Business income or loss from non-unitary partnerships,

8

8

trusts, or estates. See instructions.

00

00

9

9

9

Add Lines 7 and 8.

00

00

10

10

10

00

00

Business income or loss. Subtract Line 9 from Line 6.

11

11

Enter the total sales everywhere. (Schedule NR, Step 6, Line 1)

12

12

Enter the total sales within Illinois. (Schedule NR, Step 6, Line 2)

13

Apportionment factor.

Divide Line 12 by Line 11 and carry to six

13

decimal places. (Schedule NR, Step 6, Line 3)

14

Business income or loss apportionable to Illinois

14

14

Multiply Line 10 by Line 13, for each column.

00

00

15

15

15

Nonbusiness income or loss allocable to Illinois. See instructions.

00

00

16

Non-unitary partnerships, trusts, or estates

16

16

business income or loss apportionable to Illinois. See instructions.

00

00

Step 4: Figure your income tax

17

Base income or loss allocable to Illinois.

Residents: Enter the amounts from Columns A and B, Line 6. (IL-1041, Line 27)

17

17

Nonresidents: For each column, add Lines 14 through 16. (Schedule NR, Line 51)

00

00

18

18

Illinois net loss deduction. See Instructions. (IL-1041, Line 30)

00

19

Income after Illinois net loss deduction. See instructions.

Column A: Subtract Column A, Line 18 from Column A, Line 17.

19

19

Column B: Enter the amount from Column B, Line 17.

00

00

20

If Column A, Line 19 is negative: enter zero in Column A, Line 20,

and enter in Column B, Line 20, the result of adding Column B, Line 19, plus

Column A, Line 19. If Column B, Line 20, is negative do not use this schedule.

If Column A, Line 19 is positive: enter Column A, Line 19, on Column A,

20

20

00

00

Line 20, and enter Column B, Line 19, on Column B, Line 20.

21

21

21

Standard Exemption. See Instructions. (IL-1041, Line 31)

00

00

22

22

00

22

00

Net Income. Subtract Line 21 from Line 20. If negative, enter zero.

23

Tax.

Column A: Multiply Line 22 by 5% (.05).

:

23

23

Column B

00

00

Multiply Line 22 by 3.75% (.0375).

24

Add Columns A and B, Line 23, and enter the total

24

here and on your Form IL-1041, Line 40.

00

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Schedule SA (IL-1041) (R-12/14)

Reset

Print

1

1