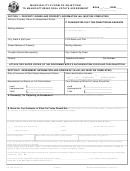

Form Pa-136 - Municipality'S Form Of Objection To Manufacturing Real Estate Assessment Page 3

ADVERTISEMENT

INDICATORS OF VALUE

The statutory standard in valuing property for assessment purposes is "...at the full value which could ordinarily be obtained

therefor at private sale. In determining the value, the assessor shall consider recent arm's-length sales of the property to be

assessed if according to professionally acceptable appraisal practices those sales conform to recent arm's-length sales of the

reasonably comparable property; recent arm's-length sales of reasonably comparable property; and all factors that, according

to professionally acceptable appraisal practices, affect the value of the property to be assessed." (Sec. 70.32 (1) Wis. Stats.)

RECENT SALE

cost new (RCN) of your building and subtracting for

the physical, functional and economic obsolescenses

If there has been a recent sale, please provide us

the property suffers. This is one of the methods the

with the sale price, the names and relationships

Department of Revenue (DOR) uses and during our

between the grantor and grantee, the date of the

field audit we do review the physical problems the

sale, the type of market exposure, the length of time

building suffers, the problems with plant layout, bay

on the market, any personal property or goodwill

sizes, ceiling heights, and problems with the

included in the sale price, the type of transfer

neighborhood, transportation access, etc.

(purchase, merger, stock transfer, etc.), the terms of

the financing and the basis for the value (book value,

INCOME APPROACH TO MARKET VALUE

independent appraisal, etc.).

You should also

There are some types of properties where any

provide us with a list of changes (and their cost)

analysis of the potential income will produce a good

made to the property between the sale date and the

indicator of market value.

One of the problems

January 1 assessment date.

typically encountered is the issue of long-term leases

REASONABLY COMPARABLE SALES

which produce a contract rent no longer favorable in

the current market place. This, in effect, has split the

The courts have stated that, in absence of a sale of

market value of the property between the lessor (the

the subject property, sales of reasonably comparable

market value of the contract rent) and the lessee (the

properties must be considered. Types of information

value resulting from having a low rent guaranteed).

you might provide would include the names of grantor

The courts have determined that we should be

and grantee, location of the property, date of sale,

looking at the market rent of a property, not

sale price (of the real property only), any special

necessarily the contract rent, when setting a market

circumstances (financing, compulsion to buy or sell

value for equitable assessment.

the property), the total area of land and of the

building, type of use (warehousing, office, light or

The information you should submit would include

heavy manufacturing), the intended use or changing

your actual rents, vacancy ratios, expenses and your

use of the property, the type of construction, age and

estimate of the capitalization rate which converts the

annual net rent to an estimate of market value. You

condition, ceiling heights, number of stories and bay

sizes.

should review what current market rents are for

properties similar to yours, what are market vacancy

It is essential that the properties used as reasonably

ratios and average expenses.

To estimate the

comparable be as similar as possible to the subject

capitalization rate you should list properties that have

property.

You should consider the differences

sold which were rented, thereby developing the rate

between these comparables and your property and

from market data. As with reasonably comparable

give us your estimate of market value considering

sales, you should take into account similarities and

those differences. Case law states that comparability

differences between your properties and those used

is measured in the adjustment process. Specific and

as comparables.

detailed adjustments for differences must be shown

in order to substantiate comparability.

OTHER INDICATORS OF VALUE

Providing an independent appraisal is beneficial. It is

COST APPROACH TO MARKET VALUE

important that you consider the purpose of that

In addition to considering the sales of like property,

appraisal

(was

it

for

insurance,

liquidation,

you should consider the original cost (adjusted for

condemnation, potential sale, etc.) and when the date

inflation and depreciation). This would be a good

of the appraisal was. One-page estimates of value

indicator of value if the building has recently been

without any supporting information would not be

built. You should provide us with your actual costs

given very much weight in our review.

and some indication whether you contracted out the

work, built part yourself or acted as general

Any other aspects of the property, or changes to the

contractor.

property we may not have been aware of should be

pointed out at this stage as well

Another alternative would be to use a current cost

service and estimate the reproduction/replacement

PA-136 (R. 05-11)

Page 3

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3