Form Pa-136 - Municipality'S Form Of Objection To Manufacturing Real Estate Assessment Page 2

ADVERTISEMENT

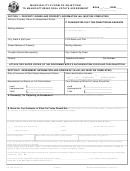

MUNICIPALITY’S FORM OF OBJECTION

BOA#___-____-REM-____

TO MANUFACTURING REAL ESTATE ASSESSMENT

(For Dept. Use Only)

SECTION 1: PROPERTY OWNER AND PROPERTY INFORMATION (ALL MUST BE COMPLETED)

Name of Property Owner on Assessment Notice:

IT IS REQUESTED THAT THIS OBJECTION BE REVIEWED

Signature of Municipal Representative

Date:

Mailing Address:

or Authorized Agent (*):

* If agent, attach written authorization to this form.

City, State & Zip Code:

Print Name and Title:

Street Address of Property:

Mailing Address:

Taxation District (Municipality):

City, State & Zip Code:

County:

Telephone Number:

Fax Number:

ATTACH TWO DATED COPIES OF THE GOVERNING BODY’S AUTHORIZATION FOR FILING THIS OBJECTION

SECTION 2: ASSESSMENT INFORMATION AND OPINION OF VALUE (ALL MUST BE COMPLETED)

Date of Issuance of Real Estate Assessment Notice:

State Identification Number:

__ __ - __ __ - ___ ___ ___ - R __ __ __ __ __ __ __ __ __

* AA

* CO

Taxation District

DOR Parcel Number

* “County of” on assessment notice is “AA” and “CO” (e.g. 76-13)

Assessment as Shown on Full Value Notice:

Your Estimate of What Full Value Should Be:

Land

$_____________________

Land

$______________________

Improvements

______________________

Improvements

_______________________

Total

$_____________________

Total

$______________________

A. Reason(s) for Objecting to Assessment:

(Additional sheet should be used and attached if needed)

B. Basis for Your Estimate of What Full Value Should Be:

as prescribed in sec. 70.32(1), Wis. Stats., shall be included for

the property in question.

(Additional sheets should be used and attached if needed.)

In the Last Five Years, Has the Property Been (Check What Applies and Enclose Two Copies of Documents):

_____ Appraised for any Reason

_____ Sold

_____ Had Marketing Opinions

_____ Offered for Sale

_____ Listed

Date of Appraisal:

Real Estate Value Estimate by Appraisal:

Name/Telephone # of Appraiser:

If you would like to discuss your objection informally prior to the State Board of Assessors' (BOA) action, please contact the district

office where the property is located.

Section 70.995 (8)(c)2. Wis. Stats., allows you to submit additional information within 60 days of your appeal to the BOA to consider in reviewing the

appeal. In order for the BOA to expedite the appeal process for you, answer the following question:

Do you intend to submit supplemental information to support documentation provided in Sec. 2, A and B to the BOA within 60 days of the appeal date?

(circle one)

Yes

No

If Yes, when will the supplemental information be supplied? (date)_____________________________ ( If yes, please mail all supplemental

information to the BOA office at address listed on page 1.)

PA-136 (R. 05-11)

Page 2

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3