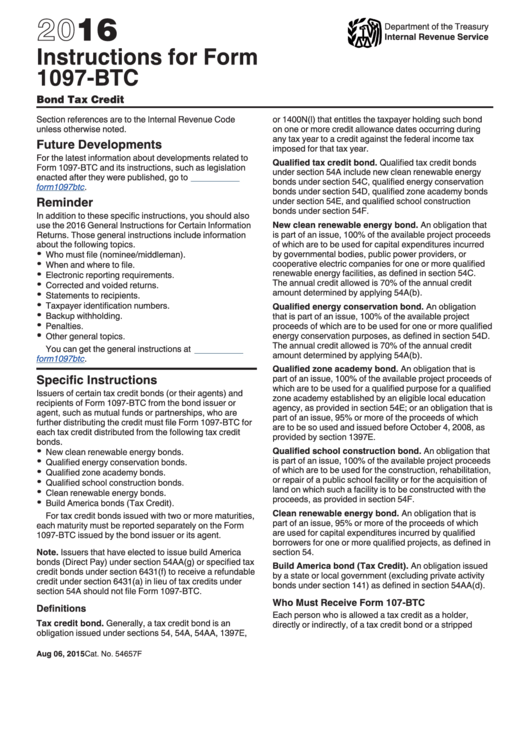

Instructions For Form 1097-Btc - Bond Tax Credit- 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form

1097-BTC

Bond Tax Credit

Section references are to the Internal Revenue Code

or 1400N(l) that entitles the taxpayer holding such bond

unless otherwise noted.

on one or more credit allowance dates occurring during

any tax year to a credit against the federal income tax

Future Developments

imposed for that tax year.

For the latest information about developments related to

Qualified tax credit bond. Qualified tax credit bonds

Form 1097-BTC and its instructions, such as legislation

under section 54A include new clean renewable energy

enacted after they were published, go to

bonds under section 54C, qualified energy conservation

form1097btc.

bonds under section 54D, qualified zone academy bonds

Reminder

under section 54E, and qualified school construction

bonds under section 54F.

In addition to these specific instructions, you should also

use the 2016 General Instructions for Certain Information

New clean renewable energy bond. An obligation that

is part of an issue, 100% of the available project proceeds

Returns. Those general instructions include information

about the following topics.

of which are to be used for capital expenditures incurred

by governmental bodies, public power providers, or

Who must file (nominee/middleman).

cooperative electric companies for one or more qualified

When and where to file.

renewable energy facilities, as defined in section 54C.

Electronic reporting requirements.

The annual credit allowed is 70% of the annual credit

Corrected and voided returns.

amount determined by applying 54A(b).

Statements to recipients.

Taxpayer identification numbers.

Qualified energy conservation bond. An obligation

Backup withholding.

that is part of an issue, 100% of the available project

Penalties.

proceeds of which are to be used for one or more qualified

energy conservation purposes, as defined in section 54D.

Other general topics.

The annual credit allowed is 70% of the annual credit

You can get the general instructions at

amount determined by applying 54A(b).

form1097btc.

Qualified zone academy bond. An obligation that is

Specific Instructions

part of an issue, 100% of the available project proceeds of

which are to be used for a qualified purpose for a qualified

Issuers of certain tax credit bonds (or their agents) and

zone academy established by an eligible local education

recipients of Form 1097-BTC from the bond issuer or

agency, as provided in section 54E; or an obligation that is

agent, such as mutual funds or partnerships, who are

part of an issue, 95% or more of the proceeds of which

further distributing the credit must file Form 1097-BTC for

are to be so used and issued before October 4, 2008, as

each tax credit distributed from the following tax credit

provided by section 1397E.

bonds.

Qualified school construction bond. An obligation that

New clean renewable energy bonds.

is part of an issue, 100% of the available project proceeds

Qualified energy conservation bonds.

of which are to be used for the construction, rehabilitation,

Qualified zone academy bonds.

or repair of a public school facility or for the acquisition of

Qualified school construction bonds.

land on which such a facility is to be constructed with the

Clean renewable energy bonds.

proceeds, as provided in section 54F.

Build America bonds (Tax Credit).

Clean renewable energy bond. An obligation that is

For tax credit bonds issued with two or more maturities,

part of an issue, 95% or more of the proceeds of which

each maturity must be reported separately on the Form

are used for capital expenditures incurred by qualified

1097-BTC issued by the bond issuer or its agent.

borrowers for one or more qualified projects, as defined in

Note. Issuers that have elected to issue build America

section 54.

bonds (Direct Pay) under section 54AA(g) or specified tax

Build America bond (Tax Credit). An obligation issued

credit bonds under section 6431(f) to receive a refundable

by a state or local government (excluding private activity

credit under section 6431(a) in lieu of tax credits under

bonds under section 141) as defined in section 54AA(d).

section 54A should not file Form 1097-BTC.

Who Must Receive Form 107-BTC

Definitions

Each person who is allowed a tax credit as a holder,

Tax credit bond. Generally, a tax credit bond is an

directly or indirectly, of a tax credit bond or a stripped

obligation issued under sections 54, 54A, 54AA, 1397E,

Aug 06, 2015

Cat. No. 54657F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4