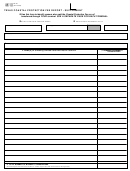

Form 28-100 (Back)(Rev.4-08/5)

INSTRUCTIONS FOR COMPLETING

THE TEXAS OYSTER SALES FEE REPORT

GENERAL INFORMATION

WHO MUST FILE - The first certified shellfish dealer who harvests,

purchases, handles, stores, packs, labels, unloads at dockside, or

holds oysters taken from Texas waters must file a report with the

Comptroller and pay the state $1 for each barrel of oysters

harvested, purchased, handled, or processed. EVEN IF YOU DO

NOT HANDLE OR ACCEPT OYSTERS FROM ANY HARVEST

BOATS IN A SPECIFIC MONTH, YOU MUST STILL FILE A REPORT

WITH ZERO AMOUNT DUE. (

Health and Safety Code, Section

436.103)

WHEN TO FILE - Reports must be filed and any fee and/or

overweight penalty due must be paid not later than the 20th day of

the month following the month in which the barrel of oysters was

handled. If the 20th day of the month falls on a weekend or legal

holiday, the due date will be the first business day following the

weekend or holiday.

BUSINESS CHANGES - It is your responsibility to notify the Comptroller's Office if your business changes or if you do not receive the correct forms

to report your Oyster Sales Fee information. Make corrections to your mailing address and/or location information directly on the form next to the

incorrect information. TO CANCEL YOUR SHELLFISH CERTIFICATE OF COMPLIANCE, YOU MUST CONTACT THE TEXAS DEPARTMENT OF

STATE HEALTH SERVICES (DSHS). You must continue to file Oyster Sales Fee Reports with the Comptroller until your Certificate of Compliance

is canceled by DSHS.

FOR ASSISTANCE - If you have any questions concerning the Oyster Sales Fee, you may contact one of our tax policy specialists toll free at

(800) 252-5555. The local number in Austin is (512) 463-4600.

DEFINITIONS

Barrel

The equivalent of three (3) 100-pound containers of oysters.

Overweight The penalty incurred for purchasing or selling containers of oyster shellstock weighing more than 110 pounds. The overweight

penalty

penalty is $5 per container weighing more than 110 pounds.

Late penalty The penalty incurred for filing and paying the Oyster Sales Fee Report after the due date. The late penalty is calculated as 10% of

the total fee and overweight penalty due as reported in Item 5.

SPECIFIC INSTRUCTIONS

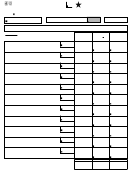

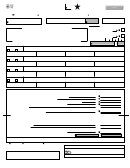

Column A - For each business location, enter the total number of

Item 2 - Enter the total fee due for the amount of oyster shellstock

pounds of oyster shellstock handled for the report period.

handled during the report period for all locations. (Multiply

Transfer this information from the Oyster Sales Fee

the figure in Item 1 by $1.) YOU MUST ENTER DOLLARS

Calendar for each location. Enter WHOLE NUMBERS

AND CENTS.

ONLY.

Column B - For each business location, enter the total number of barrels

Item 3 - Enter the total number of containers handled by all locations

of oyster shellstock handled for the report period. To

that weighed more than 110 pounds (add Column C for all

calculate the number of barrels handled, divide the figure in

locations). ENTER WHOLE NUMBERS ONLY.

Column A by 300, then round the result to 2 decimal places.

Item 4 - Enter the total overweight penalty due for all locations

YOU MUST ENTER TWO DECIMAL PLACES, EVEN IF

(Multiply the figure in Item 3 by $5.) YOU MUST ENTER

THE RESULT OF YOUR CALCULATION IS A WHOLE

WHOLE DOLLARS.

NUMBER. (Example: Enter 617.00 if the result is 617 or

735.34 if the result is 735.335) The number of barrels

Item 5 - Enter the total fee and overweight penalty due for all

entered in Column B should match number of barrels from

business locations (Item 2 + Item 4). YOU MUST ENTER

the Oyster Sales Fee Calendar for each location.

DOLLARS AND CENTS.

Column C - For each business location, enter the total number of

Item 6 - LATE PENALTY. If you are filing your report AFTER the due

containers of oyster shellstock handled for the report period

date, enter 10% of the amount in Item 5.

that weighed more than 110 lbs. Transfer this information

Item 7 - INTEREST. If any fee or overweight penalty is unpaid 61

from the Oyster Sales Fee Calendar for each location.

days AFTER the due date, enter interest on the amount in

Item 5 calculated at the rate published in Pub. 98-304,

Item 1 -

Enter the total number of barrels of oyster shellstock

online at , or toll free at

handled by all locations (add Column B for all locations).

(877) 447-2834.

YOU MUST ENTER TWO DECIMAL PLACES, EVEN IF

THE RESULT OF YOUR CALCULATION IS A WHOLE

Item 8 - Enter the total fee, overweight penalty, late penalty and

NUMBER.

interest due for the report period (add Items 5 - 7).

1

1 2

2