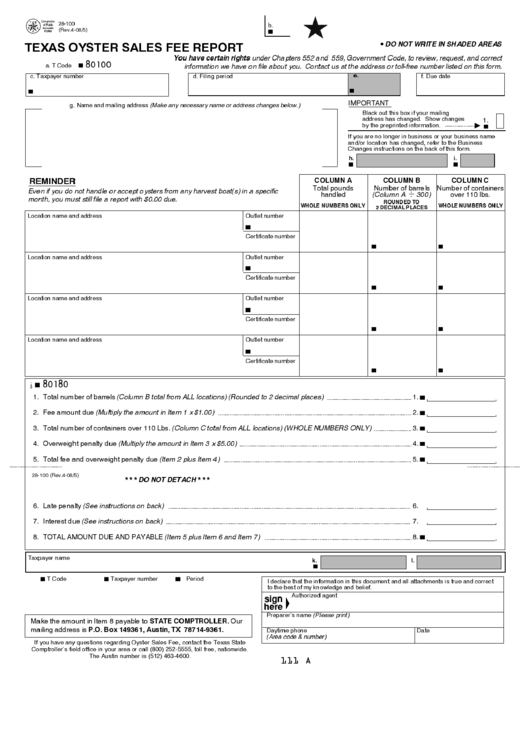

b.

28-100

(Rev.4-08/5)

TEXAS OYSTER SALES FEE REPORT

DO NOT WRITE IN SHADED AREAS

You have certain rights under Chapters 552 and 559, Government Code, to review, request, and correct

80100

a. T Code

information we have on file about you. Contact us at the address or toll-free number listed on this form.

c. Taxpayer number

d. Filing period

f. Due date

e.

IMPORTANT

g. Name and mailing address (Make any necessary name or address changes below.)

Black out this box if your mailing

address has changed. Show changes

1.

by the preprinted information.

If you are no longer in business or your business name

and/or location has changed, refer to the Business

Changes instructions on the back of this form.

h.

i.

REMINDER

COLUMN A

COLUMN B

COLUMN C

Total pounds

Number of barrels

Number of containers

Even if you do not handle or accept oysters from any harvest boat(s) in a specific

handled

(Column A

300)

over 110 lbs.

.

month, you must still file a report with $0.00 due.

.

ROUNDED TO

WHOLE NUMBERS ONLY

WHOLE NUMBERS ONLY

2 DECIMAL PLACES

Location name and address

Outlet number

Certificate number

Location name and address

Outlet number

Certificate number

Location name and address

Outlet number

Certificate number

Location name and address

Outlet number

Certificate number

80180

j.

1. Total number of barrels (Column B total from ALL locations) (Rounded to 2 decimal places)

1.

2. Fee amount due (Multiply the amount in Item 1 x $1.00)

2.

3. Total number of containers over 110 Lbs. (Column C total from ALL locations) (WHOLE NUMBERS ONLY)

3.

4. Overweight penalty due (Multiply the amount in Item 3 x $5.00)

4.

5. Total fee and overweight penalty due (Item 2 plus Item 4)

5.

* * * DO NOT DETACH * * *

28-100 (Rev.4-08/5)

6. Late penalty (See instructions on back)

6.

7. Interest due (See instructions on back)

7.

8. TOTAL AMOUNT DUE AND PAYABLE (Item 5 plus Item 6 and Item 7)

8.

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 8 payable to STATE COMPTROLLER. Our

mailing address is P.O. Box 149361, Austin, TX 78714-9361.

Daytime phone

Date

(Area code & number)

If you have any questions regarding Oyster Sales Fee, contact the Texas State

Comptroller's field office in your area or call (800) 252-5555, toll free, nationwide.

The Austin number is (512) 463-4600.

111 A

1

1 2

2