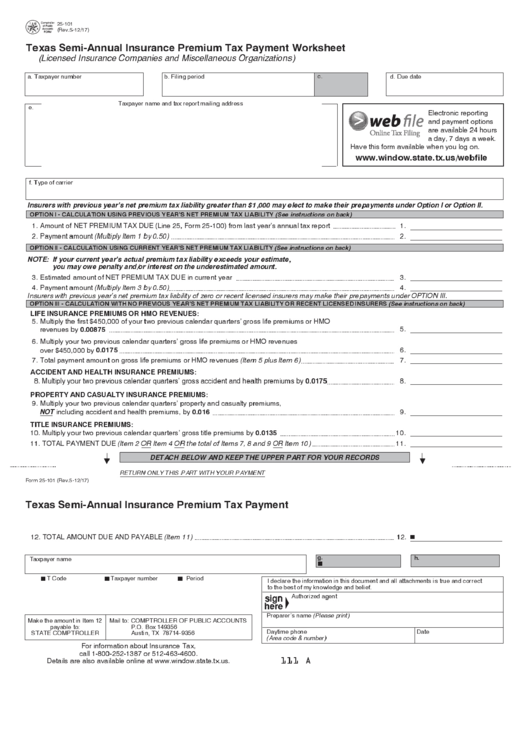

25-101

(Rev.5-12/17)

PRINT FORM

RESET FORM

Texas Semi-Annual Insurance Premium Tax Payment Worksheet

(Licensed Insurance Companies and Miscellaneous Organizations)

c.

a. Taxpayer number

b. Filing period

d. Due date

Taxpayer name and tax report mailing address

e.

Electronic reporting

and payment options

are available 24 hours

a day, 7 days a week.

Have this form available when you log on.

f. Type of carrier

Insurers with previous year's net premium tax liability greater than $1,000 may elect to make their prepayments under Option I or Option II.

OPTION I - CALCULATION USING PREVIOUS YEAR'S NET PREMIUM TAX LIABILITY

(See instructions on back)

1. Amount of NET PREMIUM TAX DUE (Line 25, Form 25-100) from last year's annual tax report

1.

2. Payment amount (Multiply Item 1 by 0.50)

2.

OPTION II - CALCULATION USING CURRENT YEAR'S NET PREMIUM TAX LIABILITY

(See instructions on back)

NOTE: If your current year's actual premium tax liability exceeds your estimate,

you may owe penalty and/or interest on the underestimated amount.

3. Estimated amount of NET PREMIUM TAX DUE in current year

3.

4. Payment amount (Multiply Item 3 by 0.50)

4.

Insurers with previous year's net premium tax liability of zero or recent licensed insurers may make their prepayments under OPTION III.

OPTION III - CALCULATION WITH NO PREVIOUS YEAR'S NET PREMIUM TAX LIABILITY OR RECENT LICENSED INSURERS

(See instructions on back)

LIFE INSURANCE PREMIUMS OR HMO REVENUES:

5. Multiply the first $450,000 of your two previous calendar quarters' gross life premiums or HMO

0.00875

5.

revenues by

6. Multiply your two previous calendar quarters' gross life premiums or HMO revenues

0.0175

over $450,000 by

6.

7. Total payment amount on gross life premiums or HMO revenues (Item 5 plus Item 6)

7.

ACCIDENT AND HEALTH INSURANCE PREMIUMS:

8. Multiply your two previous calendar quarters' gross accident and health premiums by 0.0175

8.

PROPERTY AND CASUALTY INSURANCE PREMIUMS:

9. Multiply your two previous calendar quarters' property and casualty premiums,

NOT

including accident and health premiums, by 0.016

9.

TITLE INSURANCE PREMIUMS:

10. Multiply your two previous calendar quarters' gross title premiums by 0.0135

10.

11.

11. TOTAL PAYMENT DUE (Item 2 OR Item 4 OR the total of Items 7, 8 and 9 OR Item 10)

DETACH BELOW AND KEEP THE UPPER PART FOR YOUR RECORDS

RETURN ONLY THIS PART WITH YOUR PAYMENT

Form 25-101 (Rev.5-12/17)

Texas Semi-Annual Insurance Premium Tax Payment

12. TOTAL AMOUNT DUE AND PAYABLE (Item 11)

12.

g.

h.

Taxpayer name

T Code

Taxpayer number

Period

I declare the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 12

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9356

(Area code & number)

For information about Insurance Tax,

call 1-800-252-1387 or 512-463-4600.

111 A

Details are also available online at

1

1 2

2