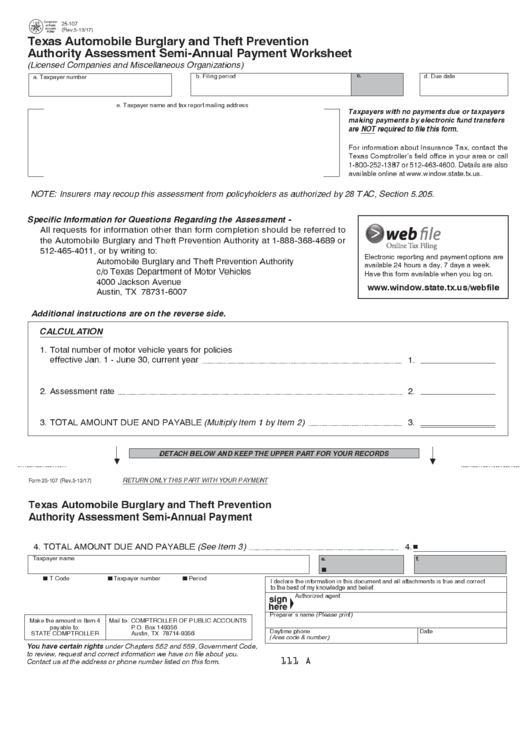

25-107

(Rev.5-13/17)

Texas Automobile Burglary and Theft Prevention

Authority Assessment Semi-Annual Payment Worksheet

(Licensed Companies and Miscellaneous Organizations)

b. Filing period

d. Due date

a. Taxpayer number

c.

e. Taxpayer name and tax report mailing address

Taxpayers with no payments due or taxpayers

making payments by electronic fund transfers

are NOT required to file this form.

For information about Insurance Tax, contact the

Texas Comptroller's field office in your area or call

1-800-252-1387 or 512-463-4600. Details are also

available online at

NOTE: Insurers may recoup this assessment from policyholders as authorized by 28 TAC, Section 5.205.

Specific Information for Questions Regarding the Assessment -

All requests for information other than form completion should be referred to

the Automobile Burglary and Theft Prevention Authority at 1-888-368-4689 or

512-465-4011, or by writing to:

Electronic reporting and payment options are

Automobile Burglary and Theft Prevention Authority

available 24 hours a day, 7 days a week.

c/o Texas Department of Motor Vehicles

Have this form available when you log on.

4000 Jackson Avenue

Austin, TX 78731-6007

Additional instructions are on the reverse side.

CALCULATION

1. Total number of motor vehicle years for policies

effective Jan. 1 - June 30, current year

1.

2. Assessment rate

2.

3. TOTAL AMOUNT DUE AND PAYABLE (Multiply Item 1 by Item 2)

3.

DETACH BELOW AND KEEP THE UPPER PART FOR YOUR RECORDS

RETURN ONLY THIS PART WITH YOUR PAYMENT

Form 25-107 (Rev.5-13/17)

Texas Automobile Burglary and Theft Prevention

Authority Assessment Semi-Annual Payment

4. TOTAL AMOUNT DUE AND PAYABLE (See Item 3)

4.

Taxpayer name

e.

f.

T Code

Taxpayer number

Period

I declare the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 4

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9356

(Area code & number)

You have certain rights

under Chapters 552 and 559, Government Code,

to review, request and correct information we have on file about you.

111 A

Contact us at the address or phone number listed on this form.

1

1 2

2