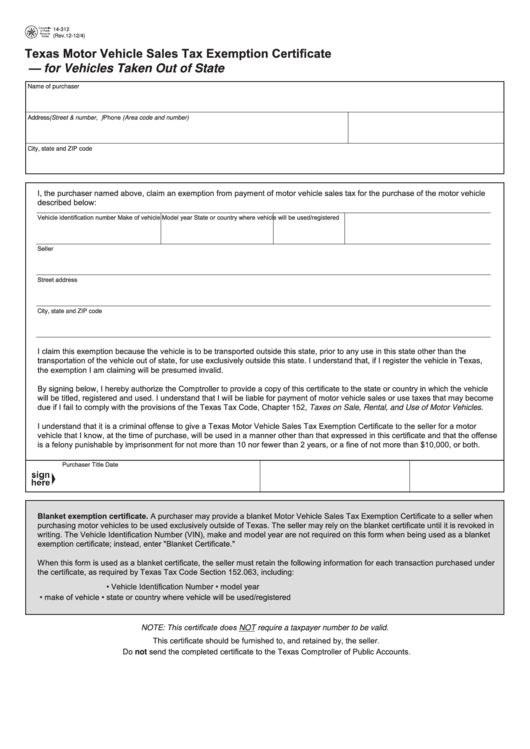

14-312

PRINT FORM

CLEAR FORM

(Rev.12-12/4)

Texas Motor Vehicle Sales Tax Exemption Certificate

— for Vehicles Taken Out of State

Name of purchaser

Address (Street & number, P.O. Box or route number)

Phone (Area code and number)

City, state and ZIP code

I, the purchaser named above, claim an exemption from payment of motor vehicle sales tax for the purchase of the motor vehicle

described below:

Vehicle identification number

Make of vehicle

Model year

State or country where vehicle will be used/registered

Seller

Street address

City, state and ZIP code

I claim this exemption because the vehicle is to be transported outside this state, prior to any use in this state other than the

transportation of the vehicle out of state, for use exclusively outside this state. I understand that, if I register the vehicle in Texas,

the exemption I am claiming will be presumed invalid.

By signing below, I hereby authorize the Comptroller to provide a copy of this certificate to the state or country in which the vehicle

will be titled, registered and used. I understand that I will be liable for payment of motor vehicle sales or use taxes that may become

due if I fail to comply with the provisions of the Texas Tax Code, Chapter 152, taxes on Sale, Rental, and Use of Motor Vehicles.

I understand that it is a criminal offense to give a Texas Motor Vehicle Sales Tax Exemption Certificate to the seller for a motor

vehicle that I know, at the time of purchase, will be used in a manner other than that expressed in this certificate and that the offense

is a felony punishable by imprisonment for not more than 10 nor fewer than 2 years, or a fine of not more than $10,000, or both.

Purchaser

Title

Date

Blanket exemption certificate. A purchaser may provide a blanket Motor Vehicle Sales Tax Exemption Certificate to a seller when

purchasing motor vehicles to be used exclusively outside of Texas. The seller may rely on the blanket certificate until it is revoked in

writing. The Vehicle Identification Number (VIN), make and model year are not required on this form when being used as a blanket

exemption certificate; instead, enter "Blanket Certificate."

When this form is used as a blanket certificate, the seller must retain the following information for each transaction purchased under

the certificate, as required by Texas Tax Code Section 152.063, including:

• Vehicle Identification Number

• model year

• make of vehicle

• state or country where vehicle will be used/registered

NOte: This certificate does NOt require a taxpayer number to be valid.

This certificate should be furnished to, and retained by, the seller.

Do not send the completed certificate to the Texas Comptroller of Public Accounts.

1

1