14-117

PRINT FORM

CLEAR FIELDS

(Rev.6-12/12)

Texas Motor Vehicle Seller-Financed

b.

Sales Tax and/or Surcharge Report

You have certain rights

under Chapters 552 and 559, Government Code,

to review, request and correct information we have on file about you.

78100

Do not write in shaded areas.

I

a.

Contact us at the address or phone number listed on this form.

d. Filing period

e.

c. Taxpayer number

f. Due date

IMPORTANT

h.

Blacken this box if your mailing address

g. Name and mailing address (Make any necessary name or address changes below.)

1.

has changed. Show changes

by the preprinted information.

Blacken this box if you are no longer

in business and write in the

2.

date you went out of business.

Month

Day

Year

ABCBCBD

i.

j.

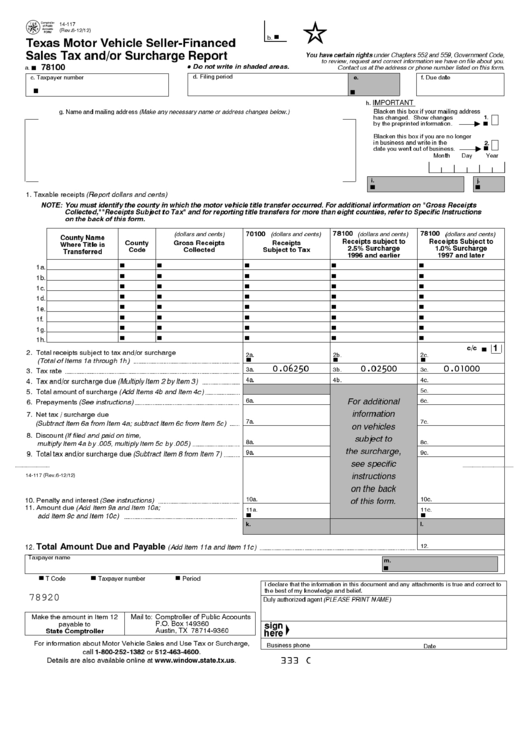

1. Taxable receipts (Report dollars and cents)

NOTE: You must identify the county in which the motor vehicle title transfer occurred. For additional information on "Gross Receipts

Collected,""Receipts Subject to Tax" and for reporting title transfers for more than eight counties, refer to Specific Instructions

on the back of this form.

78100

78100

70100

(dollars and cents)

(dollars and cents)

(dollars and cents)

(dollars and cents)

County Name

Receipts subject to

Receipts Subject to

County

Gross Receipts

Receipts

Where Title is

2.5% Surcharge

1.0% Surcharge

Code

Collected

Subject to Tax

Transferred

1996 and earlier

1997 and later

1a.

1b.

1c.

1d.

1e.

1f.

1g.

1h.

1

c/c

2. Total receipts subject to tax and/or surcharge

2a.

2b.

2c.

(Total of Items 1a through 1h)

3a.

0.06250

3b.

0.02500

3c.

0.01000

3. Tax rate

4a.

4. Tax and/or surcharge due (Multiply Item 2 by Item 3)

4b.

4c.

5c.

5. Total amount of surcharge (Add Items 4b and Item 4c)

For additional

6a.

6c.

6. Prepayments (See instructions)

information

7. Net tax / surcharge due

7a.

7c.

(Subtract Item 6a from Item 4a; subtract Item 6c from Item 5c)

on vehicles

8. Discount (If filed and paid on time,

subject to

8a.

8c.

multiply Item 4a by .005, multiply Item 5c by .005)

the surcharge,

9a.

9c.

9. Total tax and/or surcharge due (Subtract Item 8 from Item 7)

see specific

instructions

14-117 (Rev.6-12/12)

on the back

of this form.

10a.

10c.

10. Penalty and interest (See instructions)

11. Amount due (Add Item 9a and Item 10a;

11a.

11c.

add Item 9c and Item 10c)

k.

l.

Total Amount Due and Payable

12.

(Add Item 11a and Item 11c)

12.

Taxpayer name

m.

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct to

the best of my knowledge and belief.

78920

Duly authorized agent (PLEASE PRINT NAME)

Make the amount in Item 12

Mail to: Comptroller of Public Accounts

P.O. Box 149360

payable to

State Comptroller

Austin, TX 78714-9360

For information about Motor Vehicle Sales and Use Tax or Surcharge,

Business phone

Date

1-800-252-1382

512-463-4600

call

or

.

333 C

Details are also available online at

.

1

1 2

2