Form 230b - Order Confirming Chapter 13 Plan

ADVERTISEMENT

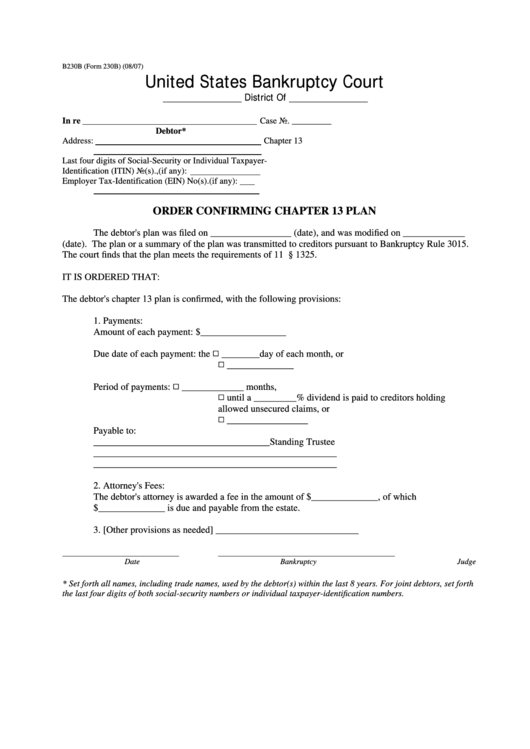

B230B (Form 230B) (08/07)

United States Bankruptcy Court

_______________ District Of _______________

In re

Case No. _________

Debtor*

Address:

Chapter 13

Last four digits of Social-Security or Individual Taxpayer-

Identification (ITIN) No(s).,(if any):

Employer Tax-Identification (EIN) No(s).(if any):

ORDER CONFIRMING CHAPTER 13 PLAN

The debtor's plan was filed on _________________ (date), and was modified on _____________

(date). The plan or a summary of the plan was transmitted to creditors pursuant to Bankruptcy Rule 3015.

The court finds that the plan meets the requirements of 11 U.S.C. § 1325.

IT IS ORDERED THAT:

The debtor's chapter 13 plan is confirmed, with the following provisions:

1. Payments:

Amount of each payment:

$__________________

Due date of each payment: the Q ________day of each month, or

Q ______________

Q _____________ months,

Period of payments:

Q until a _________% dividend is paid to creditors holding

allowed unsecured claims, or

Q _________________

Payable to:

_____________________________________Standing Trustee

___________________________________________________

___________________________________________________

2. Attorney's Fees:

The debtor's attorney is awarded a fee in the amount of $______________, of which

$______________ is due and payable from the estate.

3. [Other provisions as needed] ______________________________

Date

Bankruptcy Judge

* Set forth all names, including trade names, used by the debtor(s) within the last 8 years. For joint debtors, set forth

the last four digits of both social-security numbers or individual taxpayer-identification numbers.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1