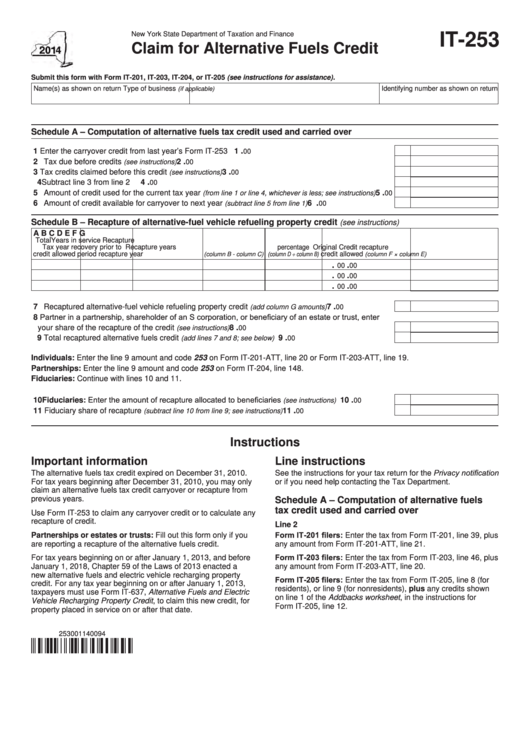

New York State Department of Taxation and Finance

IT-253

Claim for Alternative Fuels Credit

Submit this form with Form IT-201, IT-203, IT-204, or IT-205 (see instructions for assistance).

Name(s) as shown on return

Type of business

Identifying number as shown on return

(if applicable)

Schedule A – Computation of alternative fuels tax credit used and carried over

.

1 Enter the carryover credit from last year’s Form IT-253 ........................................................................

1

00

.

2 Tax due before credits

.................................................................................................

2

(see instructions)

00

.

3 Tax credits claimed before this credit

..........................................................................

3

(see instructions)

00

.

4 Subtract line 3 from line 2 .....................................................................................................................

4

00

.

5 Amount of credit used for the current tax year

.....

5

(from line 1 or line 4, whichever is less; see instructions)

00

.

6 Amount of credit available for carryover to next year

.....................................

6

(subtract line 5 from line 1)

00

Schedule B – Recapture of alternative-fuel vehicle refueling property credit

(see instructions)

A

B

C

D

E

F

G

l

Tota

Years in service

Recapture

Tax year

recovery

prior to

Recapture years

percentage

Original

Credit recapture

credit allowed

period

recapture year

credit allowed

(column B - column C) (column D ÷ column B)

(column F × column E)

.

.

00

00

.

.

00

00

.

.

00

00

.

7 Recaptured alternative-fuel vehicle refueling property credit

............................

7

(add column G amounts)

00

8 Partner in a partnership, shareholder of an S corporation, or beneficiary of an estate or trust, enter

.

your share of the recapture of the credit

.................................................................

8

(see instructions)

00

.

9 Total recaptured alternative fuels credit

....................................................

9

(add lines 7 and 8; see below)

00

Individuals: Enter the line 9 amount and code 253 on Form IT-201-ATT, line 20 or Form IT-203-ATT, line 19.

Partnerships: Enter the line 9 amount and code 253 on Form IT-204, line 148.

Fiduciaries: Continue with lines 10 and 11.

10 Fiduciaries: Enter the amount of recapture allocated to beneficiaries

.

......................

10

(see instructions)

00

.

11 Fiduciary share of recapture

.................................................

11

(subtract line 10 from line 9; see instructions)

00

Instructions

Important information

Line instructions

See the instructions for your tax return for the Privacy notification

The alternative fuels tax credit expired on December 31, 2010.

For tax years beginning after December 31, 2010, you may only

or if you need help contacting the Tax Department.

claim an alternative fuels tax credit carryover or recapture from

previous years.

Schedule A – Computation of alternative fuels

tax credit used and carried over

Use Form IT-253 to claim any carryover credit or to calculate any

recapture of credit.

Line 2

Form IT-201 filers: Enter the tax from Form IT-201, line 39, plus

Partnerships or estates or trusts: Fill out this form only if you

are reporting a recapture of the alternative fuels credit.

any amount from Form IT-201-ATT, line 21.

Form IT-203 filers: Enter the tax from Form IT-203, line 46, plus

For tax years beginning on or after January 1, 2013, and before

January 1, 2018, Chapter 59 of the Laws of 2013 enacted a

any amount from Form IT-203-ATT, line 20.

new alternative fuels and electric vehicle recharging property

Form IT-205 filers: Enter the tax from Form IT-205, line 8 (for

credit. For any tax year beginning on or after January 1, 2013,

residents), or line 9 (for nonresidents), plus any credits shown

taxpayers must use Form IT-637, Alternative Fuels and Electric

on line 1 of the Addbacks worksheet, in the instructions for

Vehicle Recharging Property Credit, to claim this new credit, for

Form IT-205, line 12.

property placed in service on or after that date.

253001140094

1

1 2

2