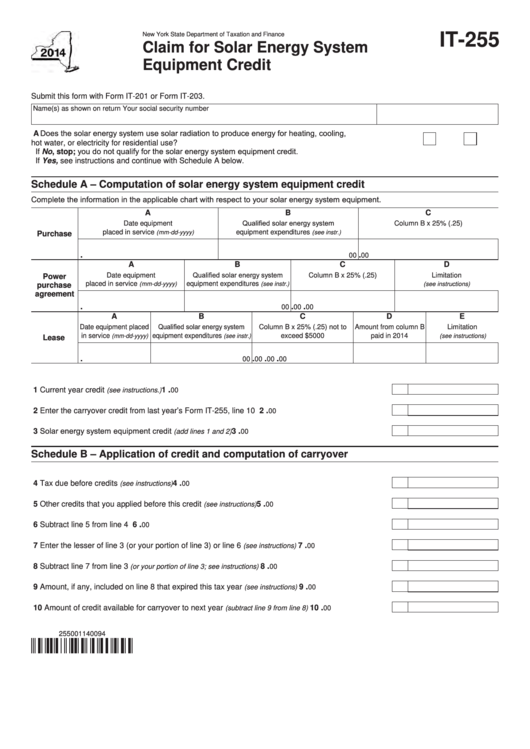

New York State Department of Taxation and Finance

IT-255

Claim for Solar Energy System

Equipment Credit

Submit this form with Form IT-201 or Form IT-203.

Name(s) as shown on return

Your social security number

A Does the solar energy system use solar radiation to produce energy for heating, cooling,

hot water, or electricity for residential use? .................................................................................................. Yes

No

If No, stop; you do not qualify for the solar energy system equipment credit.

If Yes, see instructions and continue with Schedule A below.

Schedule A – Computation of solar energy system equipment credit

Complete the information in the applicable chart with respect to your solar energy system equipment.

A

B

C

Date equipment

Qualified solar energy system

Column B x 25% (.25)

placed in service

equipment expenditures

(mm-dd-yyyy)

(see instr.)

Purchase

00

00

.

.

A

B

C

D

Date equipment

Qualified solar energy system

Column B x 25% (.25)

Limitation

Power

placed in service

equipment expenditures

(mm-dd-yyyy)

(see instr.)

(see instructions)

purchase

agreement

00

00

00

.

.

.

A

B

C

D

E

Date equipment placed

Qualified solar energy system

Column B x 25% (.25) not to

Amount from column B

Limitation

in service

equipment expenditures

exceed $5000

paid in 2014

(mm-dd-yyyy)

(see instr.)

(see instructions)

Lease

00

00

00

00

.

.

.

.

1 Current year credit

.....................................................................................................

00

.

1

(see instructions.)

2 Enter the carryover credit from last year’s Form IT-255, line 10 ..........................................................

00

.

2

3 Solar energy system equipment credit

.....................................................................

00

.

3

(add lines 1 and 2)

Schedule B – Application of credit and computation of carryover

4 Tax due before credits

................................................................................................

00

.

4

(see instructions)

5 Other credits that you applied before this credit

........................................................

00

.

5

(see instructions)

6 Subtract line 5 from line 4 ....................................................................................................................

00

.

6

7 Enter the lesser of line 3 (or your portion of line 3) or line 6

......................................

00

.

7

(see instructions)

8 Subtract line 7 from line 3

........................................................

00

.

8

(or your portion of line 3; see instructions)

9 Amount, if any, included on line 8 that expired this tax year

......................................

00

.

9

(see instructions)

10 Amount of credit available for carryover to next year

................................... 10

00

.

(subtract line 9 from line 8)

255001140094

1

1