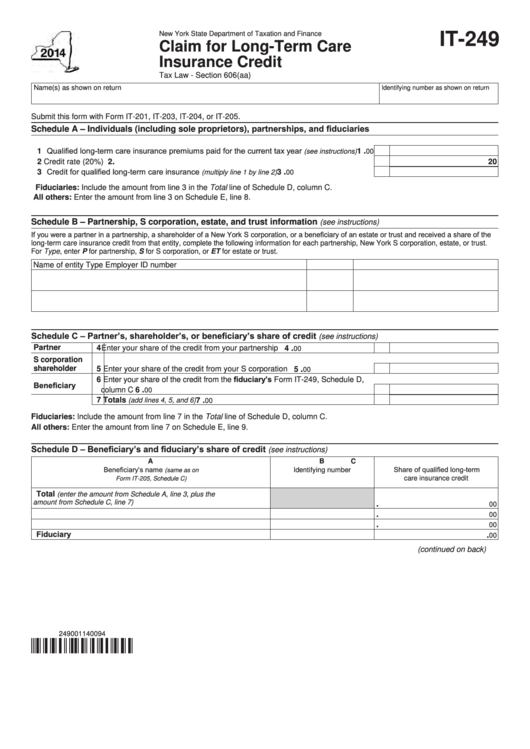

New York State Department of Taxation and Finance

IT-249

Claim for Long-Term Care

Insurance Credit

Tax Law - Section 606(aa)

Name(s) as shown on return

Identifying number as shown on return

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Schedule A – Individuals (including sole proprietors), partnerships, and fiduciaries

1 Qualified long-term care insurance premiums paid for the current tax year

.

......

1

(see instructions)

00

.

2 Credit rate (20%) .........................................................................................................................

2

20

3 Credit for qualified long-term care insurance

.

...........................................

3

(multiply line 1 by line 2)

00

Fiduciaries: Include the amount from line 3 in the Total line of Schedule D, column C.

All others: Enter the amount from line 3 on Schedule E, line 8.

Schedule B – Partnership, S corporation, estate, and trust information

(see instructions)

If you were a partner in a partnership, a shareholder of a New York S corporation, or a beneficiary of an estate or trust and received a share of the

long-term care insurance credit from that entity, complete the following information for each partnership, New York S corporation, estate, or trust.

For Type, enter P for partnership, S for S corporation, or ET for estate or trust.

Name of entity

Type

Employer ID number

Schedule C – Partner’s, shareholder’s, or beneficiary’s share of credit

(see instructions)

Partner

.

4 Enter your share of the credit from your partnership .......................................

4

00

S corporation

shareholder

5 Enter your share of the credit from your S corporation ....................................

.

5

00

6 Enter your share of the credit from the fiduciary’s Form IT-249, Schedule D,

Beneficiary

.

column C .........................................................................................................

6

00

7 Totals

...............................................................................

.

(add lines 4, 5, and 6)

7

00

Fiduciaries: Include the amount from line 7 in the Total line of Schedule D, column C.

All others: Enter the amount from line 7 on Schedule E, line 9.

Schedule D – Beneficiary’s and fiduciary’s share of credit

(see instructions)

A

B

C

Beneficiary’s name

Share of qualified long-term

Identifying number

(same as on

care insurance credit

Form IT-205, Schedule C)

Total

(enter the amount from Schedule A, line 3, plus the

amount from Schedule C, line 7)

.

00

.

00

.

00

Fiduciary

.

00

(continued on back)

249001140094

1

1 2

2