Form Ct-605 - Claim For Ez Investment Tax Credit And Ez Employment Incentive Credit For The Financial Services Industry - 2014

ADVERTISEMENT

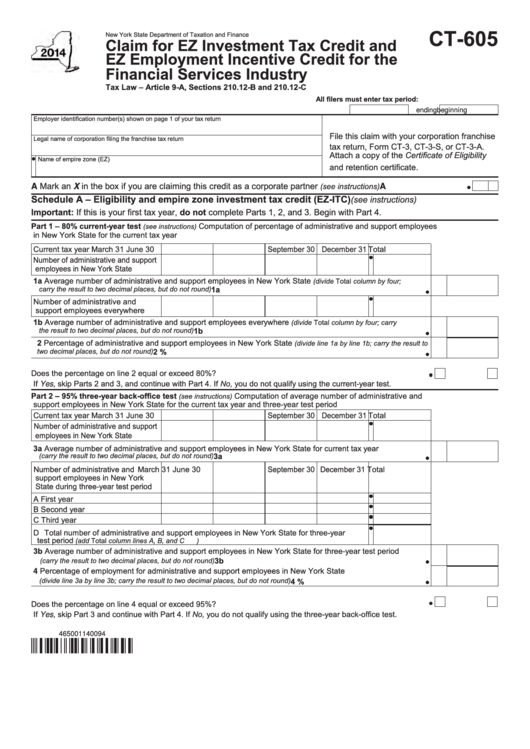

CT-605

New York State Department of Taxation and Finance

Claim for EZ Investment Tax Credit and

EZ Employment Incentive Credit for the

Financial Services Industry

Tax Law – Article 9-A, Sections 210.12-B and 210.12-C

All filers must enter tax period:

beginning

ending

Employer identification number(s) shown on page 1 of your tax return

File this claim with your corporation franchise

Legal name of corporation filing the franchise tax return

tax return, Form CT-3, CT-3-S, or CT-3-A.

Attach a copy of the Certificate of Eligibility

Name of empire zone (EZ)

and retention certificate.

A Mark an X in the box if you are claiming this credit as a corporate partner

.................................

(see instructions)

A

Schedule A – Eligibility and empire zone investment tax credit (EZ-ITC)

(see instructions)

Important: If this is your first tax year, do not complete Parts 1, 2, and 3. Begin with Part 4.

Part 1 – 80% current-year test

Computation of percentage of administrative and support employees

(see instructions)

in New York State for the current tax year

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and support

employees in New York State

1a Average number of administrative and support employees in New York State

(divide Total column by four;

...........................................................................................

carry the result to two decimal places, but do not round)

1a

Number of administrative and

support employees everywhere

1b Average number of administrative and support employees everywhere

(divide Total column by four; carry

...................................................................................................

the result to two decimal places, but do not round)

1b

2 Percentage of administrative and support employees in New York State

(divide line 1a by line 1b; carry the result to

.....................................................................................................................

2

%

two decimal places, but do not round)

Does the percentage on line 2 equal or exceed 80%? ............................................................................................Yes

No

If Yes, skip Parts 2 and 3, and continue with Part 4. If No, you do not qualify using the current-year test.

Part 2 – 95% three-year back-office test

Computation of average number of administrative and

(see instructions)

support employees in New York State for the current tax year and three-year test period

Current tax year

March 31

June 30

September 30 December 31

Total

Number of administrative and support

employees in New York State

3a Average number of administrative and support employees in New York State for current tax year

..........................................................................................

3a

(carry the result to two decimal places, but do not round)

Number of administrative and

March 31

June 30

September 30 December 31

Total

support employees in New York

State during three-year test period

A First year

B Second year

C Third year

D Total number of administrative and support employees in New York State for three-year

test period

............................................................................

(add Total column lines A, B, and C)

3b Average number of administrative and support employees in New York State for three-year test period

..........................................................................................

3b

(carry the result to two decimal places, but do not round)

4 Percentage of employment for administrative and support employees in New York State

.......................................................

(divide line 3a by line 3b; carry the result to two decimal places, but do not round)

4

%

Does the percentage on line 4 equal or exceed 95%? ............................................................................................Yes

No

If Yes, skip Part 3 and continue with Part 4. If No, you do not qualify using the three-year back-office test.

465001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4