Form Ct-602 - Claim For Ez Capital Tax Credit - 2014

ADVERTISEMENT

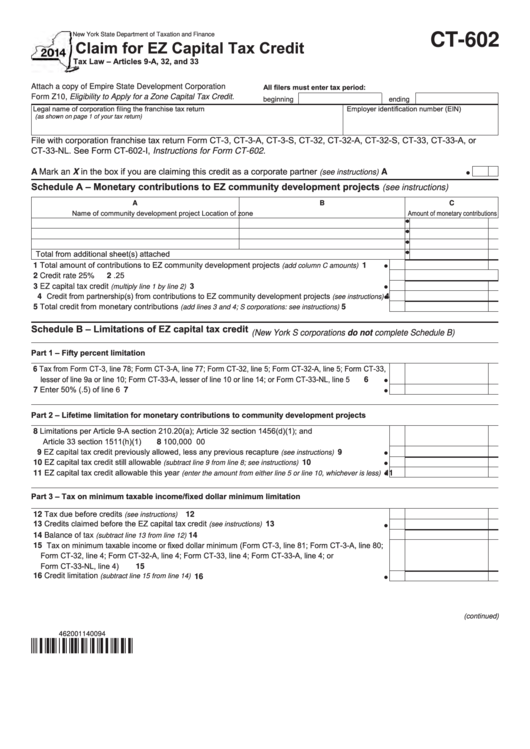

New York State Department of Taxation and Finance

CT-602

Claim for EZ Capital Tax Credit

Tax Law – Articles 9-A, 32, and 33

All filers must enter tax period:

Attach a copy of Empire State Development Corporation

Form Z10, Eligibility to Apply for a Zone Capital Tax Credit.

beginning

ending

Legal name of corporation filing the franchise tax return

Employer identification number (EIN)

(as shown on page 1 of your tax return)

File with corporation franchise tax return Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A, or

CT-33-NL. See Form CT-602-I, Instructions for Form CT-602.

. ..............................

A

Mark an X in the box if you are claiming this credit as a corporate partner

A

(see instructions)

Schedule A – Monetary contributions to EZ community development projects

(see instructions)

A

B

C

Name of community development project

Location of zone

Amount of monetary contributions

T otal from additional sheet(s) attached ............................................................................................................

1 Total amount of contributions to EZ community development projects

.........

1

(add column C amounts)

.25

2 Credit rate 25% ...................................................................................................................................

2

3 EZ capital tax credit

.......................................................................................

3

(multiply line 1 by line 2)

4 Credit from partnership(s) from contributions to EZ community development projects

4

(see instructions)

5 Total credit from monetary contributions

...................

5

(add lines 3 and 4; S corporations: see instructions)

Schedule B – Limitations of EZ capital tax credit

(New York S corporations do not complete Schedule B)

Part 1 – Fifty percent limitation

6 Tax from Form CT-3, line 78; Form CT-3-A, line 77; Form CT-32, line 5; Form CT-32-A, line 5; Form CT-33,

lesser of line 9a or line 10; Form CT-33-A, lesser of line 10 or line 14; or Form CT-33-NL, line 5 .........

6

7 Enter 50% (.5) of line 6 .....................................................................................................................

7

Part 2 – Lifetime limitation for monetary contributions to community development projects

8 Limitations per Article 9-A section 210.20(a); Article 32 section 1456(d)(1); and

Article 33 section 1511(h)(1) ............................................................................................................

8

100,000 00

9 EZ capital tax credit previously allowed, less any previous recapture

.....................

9

(see instructions)

10 EZ capital tax credit still allowable

. .....................................

10

(subtract line 9 from line 8; see instructions)

11 EZ capital tax credit allowable this year

11

(enter the amount from either line 5 or line 10, whichever is less)

Part 3 – Tax on minimum taxable income/fixed dollar minimum limitation

12 Tax due before credits

. ............................................................................................... 12

(see instructions)

13 Credits claimed before the EZ capital tax credit

......................................................

13

(see instructions)

........................................................................................... 14

14 Balance of tax

(subtract line 13 from line 12)

15 Tax on minimum taxable income or fixed dollar minimum (Form CT-3, line 81; Form CT-3-A, line 80;

Form CT-32, line 4; Form CT-32-A, line 4; Form CT-33, line 4; Form CT-33-A, line 4; or

Form CT-33-NL, line 4) ..................................................................................................................... 15

.......................................................................................

16 Credit limitation

(subtract line 15 from line 14)

16

(continued)

462001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2