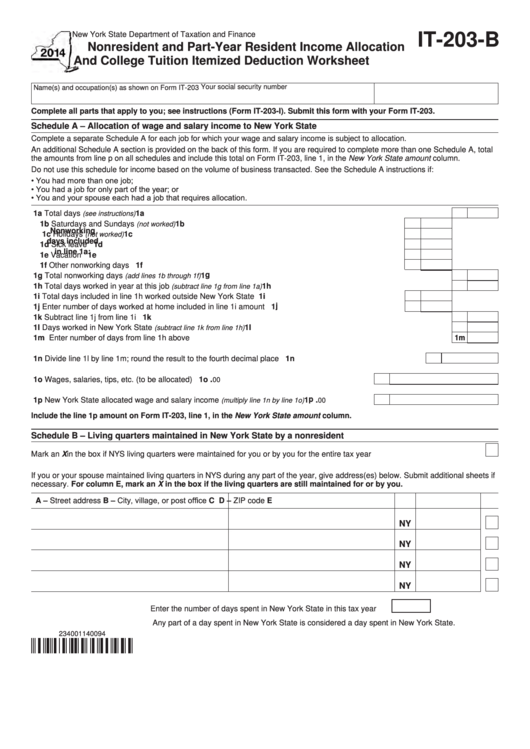

New York State Department of Taxation and Finance

IT-203-B

Nonresident and Part-Year Resident Income Allocation

And College Tuition Itemized Deduction Worksheet

Your social security number

Name(s) and occupation(s) as shown on Form IT-203

Complete all parts that apply to you; see instructions (Form IT-203-I). Submit this form with your Form IT-203.

Schedule A – Allocation of wage and salary income to New York State

Complete a separate Schedule A for each job for which your wage and salary income is subject to allocation.

An additional Schedule A section is provided on the back of this form. If you are required to complete more than one Schedule A, total

the amounts from line p on all schedules and include this total on Form IT-203, line 1, in the New York State amount column.

Do not use this schedule for income based on the volume of business transacted. See the Schedule A instructions if:

• You had more than one job;

• You had a job for only part of the year; or

• You and your spouse each had a job that requires allocation.

1a Total days

............................................................................................................................................... 1a

(see instructions)

1b Saturdays and Sundays

.................................................................... 1b

(not worked)

Nonworking

1c Holidays

............................................................................................ 1c

(not worked)

days included

1d Sick leave ............................................................................................................. 1d

in line 1a:

1e Vacation ............................................................................................................... 1e

1f Other nonworking days ........................................................................................ 1f

................................................................................................................. 1 g

1g Total nonworking days

(add lines 1b through 1f)

1h Total days worked in year at this job

..................................................................................... 1h

(subtract line 1g from line 1a)

1i Total days included in line 1h worked outside New York State ...................................................................

1i

1 j

1j Enter number of days worked at home included in line 1i amount .............................................................

1k Subtract line 1j from line 1i .............................................................................................................................................. 1k

1l Days worked in New York State

............................................................................................

1l

(subtract line 1k from line 1h)

1m Enter number of days from line 1h above ....................................................................................................................... 1m

1n Divide line 1l by line 1m; round the result to the fourth decimal place ................................................................ 1n

.

1o Wages, salaries, tips, etc. (to be allocated) ................................................................................. 1o

00

.............................. 1 p

.

1p New York State allocated wage and salary income

(multiply line 1n by line 1o)

00

Include the line 1p amount on Form IT-203, line 1, in the New York State amount column.

Schedule B – Living quarters maintained in New York State by a nonresident

Mark an X in the box if NYS living quarters were maintained for you or by you for the entire tax year .................................................

If you or your spouse maintained living quarters in NYS during any part of the year, give address(es) below. Submit additional sheets if

necessary. For column E, mark an X in the box if the living quarters are still maintained for or by you.

B – City, village, or post office

A – Street address

C

D – ZIP code

E

NY

NY

NY

NY

Enter the number of days spent in New York State in this tax year .....

Any part of a day spent in New York State is considered a day spent in New York State.

234001140094

1

1 2

2