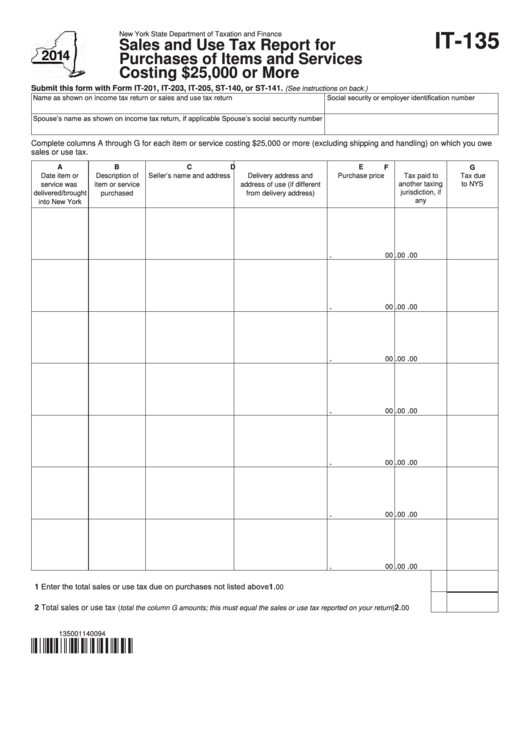

Form It-135 - Sales And Use Tax Report For Purchases Of Items And Services - 2014

ADVERTISEMENT

New York State Department of Taxation and Finance

IT-135

Sales and Use Tax Report for

Purchases of Items and Services

Costing $25,000 or More

Submit this form with Form IT-201, IT-203, IT-205, ST-140, or ST-141.

(See instructions on back.)

Social security or employer identification number

Name as shown on income tax return or sales and use tax return

Spouse’s name as shown on income tax return, if applicable

Spouse’s social security number

Complete columns A through G for each item or service costing $25,000 or more (excluding shipping and handling) on which you owe

sales or use tax.

A

B

C

D

E

G

F

Date item or

Description of

Seller’s name and address

Delivery address and

Purchase price

Tax paid to

Tax due

another taxing

to NYS

service was

item or service

address of use (if different

delivered/brought

jurisdiction, if

purchased

from delivery address)

any

into New York

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

.

.

.

00

00

00

1 Enter the total sales or use tax due on purchases not listed above ........................................................................

.

1

00

.

2 Total sales or use tax

...............

2

(total the column G amounts; this must equal the sales or use tax reported on your return)

00

135001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2