Form Ct-637 - Alternative Fuels And Electric Vehicle Recharging Property Credit - 2014

ADVERTISEMENT

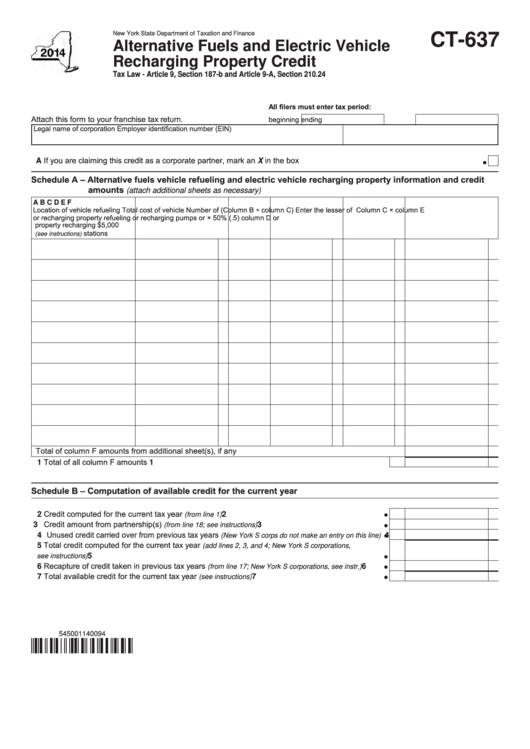

New York State Department of Taxation and Finance

CT-637

Alternative Fuels and Electric Vehicle

Recharging Property Credit

Tax Law - Article 9, Section 187-b and Article 9-A, Section 210.24

All filers must enter tax period:

Attach this form to your franchise tax return.

beginning

ending

Legal name of corporation

Employer identification number (EIN)

A If you are claiming this credit as a corporate partner, mark an X in the box ..................................................................................

Schedule A – Alternative fuels vehicle refueling and electric vehicle recharging property information and credit

amounts

(attach additional sheets as necessary)

A

B

C

D

E

F

Location of vehicle refueling

Total cost of vehicle

Number of (Column B ÷ column C) Enter the lesser of

Column C × column E

or recharging property

refueling or recharging

pumps or

× 50% (.5)

column D or

property

recharging

$5,000

stations

(see instructions)

Total of column F amounts from additional sheet(s), if any .............................................................................

1 Total of all column F amounts .............................................................................................................

1

Schedule B – Computation of available credit for the current year

2 Credit computed for the current tax year

........................................................................

2

(from line 1)

3 Credit amount from partnership(s)

.......................................................

3

(from line 18; see instructions)

4 Unused credit carried over from previous tax years

4

(New York S corps do not make an entry on this line)

5 Total credit computed for the current tax year

(add lines 2, 3, and 4; New York S corporations,

...............................................................................................................................

5

see instructions)

6 Recapture of credit taken in previous tax years

........

6

(from line 17; New York S corporations, see instr.)

7 Total available credit for the current tax year

..........................................................

7

(see instructions)

545001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2