Form 765-Gp - Kentucky General Partnership Income Return - 2012

ADVERTISEMENT

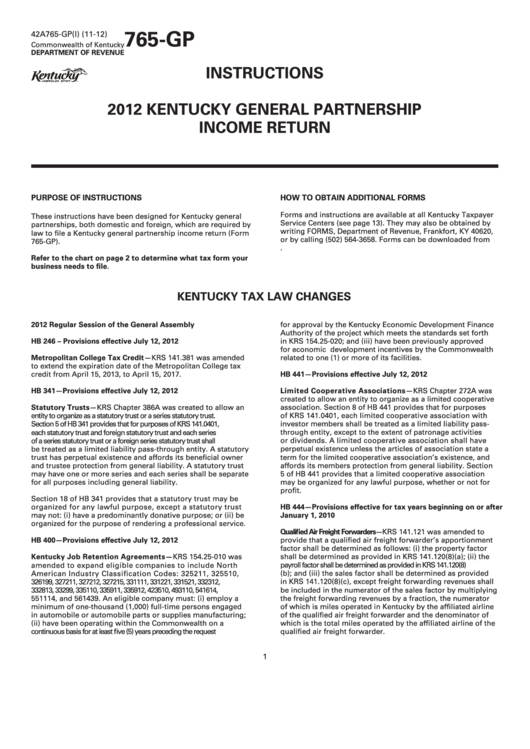

765-GP

42A765-GP(I) (11-12)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS

2012 KENTUCKY GENERAL PARTNERSHIP

INCOME RETURN

PURPOSE OF INSTRUCTIONS

HOW TO OBTAIN ADDITIONAL FORMS

Forms and instructions are available at all Kentucky Taxpayer

These instructions have been designed for Kentucky general

Service Centers (see page 13). They may also be obtained by

partnerships, both domestic and foreign, which are required by

writing FORMS, Department of Revenue, Frankfort, KY 40620,

law to file a Kentucky general partnership income return (Form

or by calling (502) 564-3658. Forms can be downloaded from

765-GP).

Refer to the chart on page 2 to determine what tax form your

business needs to file.

KENTUCKY TAX LAW CHANGES

2012 Regular Session of the General Assembly

for approval by the Kentucky Economic Development Finance

Authority of the project which meets the standards set forth

HB 246 – Provisions effective July 12, 2012

in KRS 154.25-020; and (iii) have been previously approved

for economic development incentives by the Commonwealth

Metropolitan College Tax Credit—KRS 141.381 was amended

related to one (1) or more of its facilities.

to extend the expiration date of the Metropolitan College tax

credit from April 15, 2013, to April 15, 2017.

HB 441—Provisions effective July 12, 2012

HB 341—Provisions effective July 12, 2012

Limited Cooperative Associations—KRS Chapter 272A was

created to allow an entity to organize as a limited cooperative

Statutory Trusts—KRS Chapter 386A was created to allow an

association. Section 8 of HB 441 provides that for purposes

entity to organize as a statutory trust or a series statutory trust.

of KRS 141.0401, each limited cooperative association with

Section 5 of HB 341 provides that for purposes of KRS 141.0401,

investor members shall be treated as a limited liability pass-

each statutory trust and foreign statutory trust and each series

through entity, except to the extent of patronage activities

of a series statutory trust or a foreign series statutory trust shall

or dividends. A limited cooperative association shall have

perpetual existence unless the articles of association state a

be treated as a limited liability pass-through entity. A statutory

trust has perpetual existence and affords its beneficial owner

term for the limited cooperative association’s existence, and

and trustee protection from general liability. A statutory trust

affords its members protection from general liability. Section

may have one or more series and each series shall be separate

5 of HB 441 provides that a limited cooperative association

for all purposes including general liability.

may be organized for any lawful purpose, whether or not for

profit.

Section 18 of HB 341 provides that a statutory trust may be

organized for any lawful purpose, except a statutory trust

HB 444—Provisions effective for tax years beginning on or after

may not: (i) have a predominantly donative purpose; or (ii) be

January 1, 2010

organized for the purpose of rendering a professional service.

Qualified Air Freight Forwarders—KRS 141.121 was amended to

HB 400—Provisions effective July 12, 2012

provide that a qualified air freight forwarder’s apportionment

factor shall be determined as follows: (i) the property factor

Kentucky Job Retention Agreements—KRS 154.25-010 was

shall be determined as provided in KRS 141.120(8)(a); (ii) the

amended to expand eligible companies to include North

payroll factor shall be determined as provided in KRS 141.120(8)

American Industry Classification Codes: 325211, 325510,

(b); and (iii) the sales factor shall be determined as provided

326199, 327211, 327212, 327215, 331111, 331221, 331521, 332312,

in KRS 141.120(8)(c), except freight forwarding revenues shall

332813, 33299, 335110, 335911, 335912, 423510, 493110, 541614,

be included in the numerator of the sales factor by multiplying

the freight forwarding revenues by a fraction, the numerator

551114, and 561439. An eligible company must: (i) employ a

minimum of one-thousand (1,000) full-time persons engaged

of which is miles operated in Kentucky by the affiliated airline

of the qualified air freight forwarder and the denominator of

in automobile or automobile parts or supplies manufacturing;

(ii) have been operating within the Commonwealth on a

which is the total miles operated by the affiliated airline of the

continuous basis for at least five (5) years preceding the request

qualified air freight forwarder.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16