Instructions For Completing Form Sr-2 - Campaign Report Of Charitable Solicitation By An Independent Paid Fund Raiser Or Fund-Raising Counsel

ADVERTISEMENT

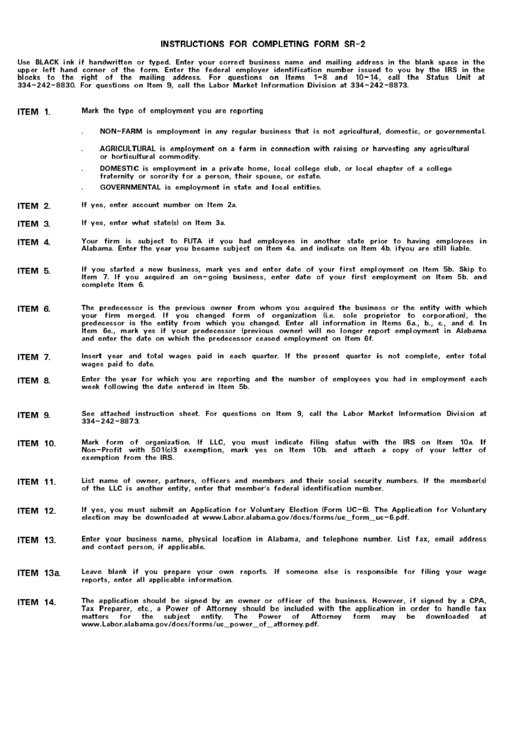

INSTRUCTIONS FOR COMPLETING FORM SR-2

Use BLACK ink if handwritten or typed. Enter your correct business name and mailing address in the blank space in the

upper left hand corner of the form. Enter the federal employer identification number issued to you by the IRS in the

blocks to the right of the mailing address. For questions on Items 1-8 and 10-14, call the Status Unit at

334-242-8830. For questions on Item 9, call the Labor Market Information Division at 334-242-8873.

Mark the type of employment you are reporting

ITEM 1.

.

NON-FARM is employment in any regular business that is not agricultural, domestic, or governmental.

.

AGRICULTURAL is employment on a farm in connection with raising or harvesting any agricultural

or horticultural commodity.

.

DOMESTIC is employment in a private home, local college club, or local chapter of a college

fraternity or sorority for a person, their spouse, or estate.

.

GOVERNMENTAL is employment in state and local entities.

If yes, enter account number on Item 2a.

ITEM 2.

If yes, enter what state(s) on Item 3a.

ITEM 3.

Your firm is subject to FUTA if you had employees in another state prior to having employees in

ITEM 4.

Alabama. Enter the year you became subject on Item 4a. and indicate on Item 4b. ifyou are still liable.

If you started a new business, mark yes and enter date of your first employment on Item 5b. Skip to

ITEM 5.

Item 7. If you acquired an on-going business, enter date of your first employment on Item 5b. and

complete Item 6.

The predecessor is the previous owner from whom you acquired the business or the entity with which

ITEM 6.

your firm merged. If you changed form of organization (i.e. sole proprietor to corporation), the

predecessor is the entity from which you changed. Enter all information in Items 6a., b., c., and d. In

Item 6e., mark yes if your predecessor (previous owner) will no longer report employment in Alabama

and enter the date on which the predecessor ceased employment on Item 6f.

Insert year and total wages paid in each quarter. If the present quarter is not complete, enter total

ITEM 7.

wages paid to date.

Enter the year for which you are reporting and the number of employees you had in employment each

ITEM 8.

week following the date entered in Item 5b.

See attached instruction sheet. For questions on Item 9, call the Labor Market Information Division at

ITEM 9.

334-242-8873.

Mark form of organization. If LLC, you must indicate filing status with the IRS on Item 10a. If

ITEM 10.

Non-Profit with 501(c)3 exemption, mark yes on Item 10b. and attach a copy of your letter of

exemption from the IRS.

List name of owner, partners, officers and members and their social security numbers. If the member(s)

ITEM 11.

of the LLC is another entity, enter that member's federal identification number.

If yes, you must submit an Application for Voluntary Election (Form UC-6). The Application for Voluntary

ITEM 12.

election may be downloaded at

Enter your business name, physical location in Alabama, and telephone number. List fax, email address

ITEM 13.

and contact person, if applicable.

Leave blank if you prepare your own reports. If someone else is responsible for filing your wage

ITEM 13a.

reports, enter all applicable information.

The application should be signed by an owner or officer of the business. However, if signed by a CPA,

ITEM 14.

Tax Preparer, etc., a Power of Attorney should be included with the application in order to handle tax

matters for the subject entity. The Power of Attorney form may be downloaded at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1