S

N

J

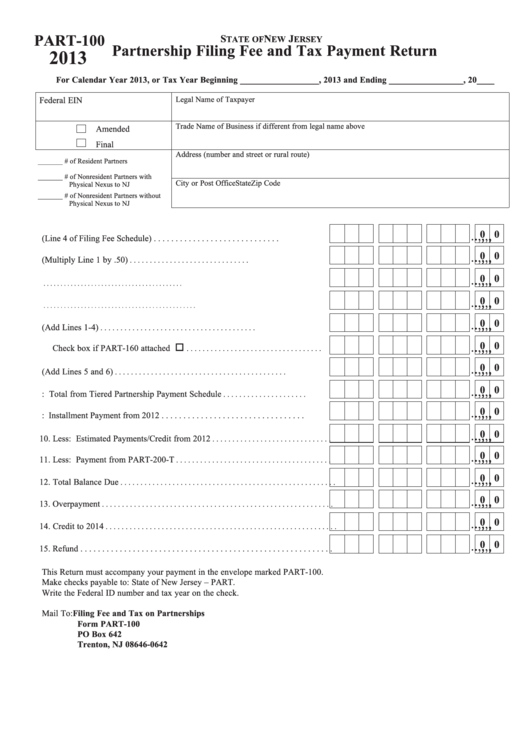

PART-100

TATE OF

EW

ERSEY

Partnership Filing Fee and Tax Payment Return

2013

For Calendar Year 2013, or Tax Year Beginning __________________, 2013 and Ending _________________, 20____

Legal Name of Taxpayer

Federal EIN

Trade Name of Business if different from legal name above

Amended

Final

Address (number and street or rural route)

_______ # of Resident Partners

_______ # of Nonresident Partners with

City or Post Office

State

Zip Code

Physical Nexus to NJ

_______ # of Nonresident Partners without

Physical Nexus to NJ

, ,

, ,

. .

0 0

1. Filing Fee (Line 4 of Filing Fee Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

2. Installment Payment (Multiply Line 1 by .50)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

3. Nonresident Noncorporate Partner Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

4. Nonresident Corporate Partner Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

5. Total Fee and Tax (Add Lines 1-4)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Penalty for Underpayment of Estimated Tax.

, ,

, ,

. .

0 0

Check box if PART-160 attached

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

7. Total Due (Add Lines 5 and 6)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

8. Less: Total from Tiered Partnership Payment Schedule

. . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

9. Less: Installment Payment from 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

10. Less: Estimated Payments/Credit from 2012

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

11. Less: Payment from PART-200-T

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

12. Total Balance Due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

13. Overpayment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

14. Credit to 2014

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

15. Refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

This Return must accompany your payment in the envelope marked PART-100.

Make checks payable to: State of New Jersey – PART.

Write the Federal ID number and tax year on the check.

Mail To: Filing Fee and Tax on Partnerships

Form PART-100

PO Box 642

Trenton, NJ 08646-0642

1

1 2

2