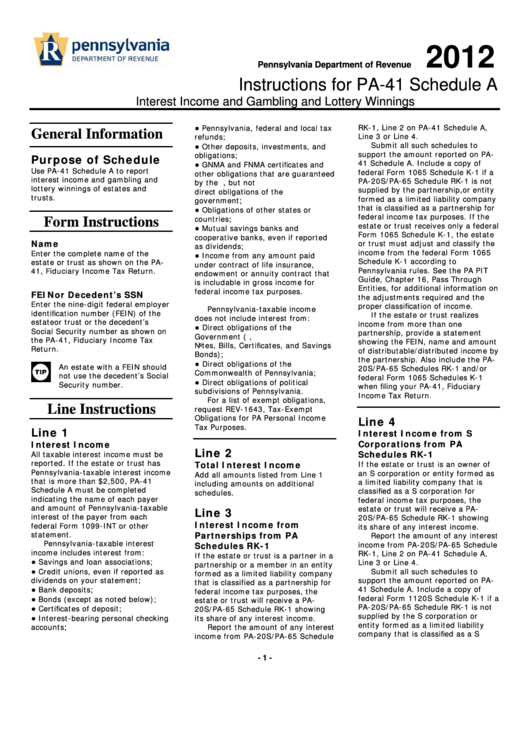

Instructions For Pa-41 Schedule A - Pennsylvania Department Of Revenue - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule A

Interest Income and Gambling and Lottery Winnings

RK-1, Line 2 on PA-41 Schedule A,

●

Pennsylvania, federal and local tax

General Information

Line 3 or Line 4.

refunds;

Submit all such schedules to

●

Other deposits, investments, and

support the amount reported on PA-

obligations;

Purpose of Schedule

41 Schedule A. Include a copy of

●

GNMA and FNMA certificates and

Use PA-41 Schedule A to report

federal Form 1065 Schedule K-1 if a

other obligations that are guaranteed

interest income and gambling and

PA-20S/PA-65 Schedule RK-1 is not

by the U.S. government, but not

lottery winnings of estates and

supplied by the partnership, or entity

direct obligations of the U.S.

trusts.

formed as a limited liability company

government;

that is classified as a partnership for

●

Obligations of other states or

federal income tax purposes. If the

countries;

Form Instructions

estate or trust receives only a federal

●

Mutual savings banks and

Form 1065 Schedule K-1, the estate

cooperative banks, even if reported

Name

or trust must adjust and classify the

as dividends;

income from the federal Form 1065

Enter the complete name of the

●

Income from any amount paid

Schedule K-1 according to

estate or trust as shown on the PA-

under contract of life insurance,

Pennsylvania rules. See the PA PIT

41, Fiduciary Income Tax Return.

endowment or annuity contract that

Guide, Chapter 16, Pass Through

is includable in gross income for

Entities, for additional information on

federal income tax purposes.

FEIN or Decedent’s SSN

the adjustments required and the

Enter the nine-digit federal employer

proper classification of income.

Pennsylvania-taxable income

identification number (FEIN) of the

If the estate or trust realizes

does not include interest from:

estate or trust or the decedent’s

income from more than one

●

Direct obligations of the U.S.

Social Security number as shown on

partnership, provide a statement

Government (U.S. Treasury Bonds,

the PA-41, Fiduciary Income Tax

showing the FEIN, name and amount

Notes, Bills, Certificates, and Savings

Return.

of distributable/distributed income by

Bonds);

the partnership. Also include the PA-

●

Direct obligations of the

An estate with a FEIN should

20S/PA-65 Schedules RK-1 and/or

Commonwealth of Pennsylvania;

not use the decedent’s Social

federal Form 1065 Schedules K-1

●

Direct obligations of political

Security number.

when filing your PA-41, Fiduciary

subdivisions of Pennsylvania.

Income Tax

Return.

For a list of exempt obligations,

Line Instructions

request REV-1643, Tax-Exempt

Obligations for PA Personal Income

Line 4

Tax Purposes.

Line 1

Interest Income from S

Corporations from PA

Interest Income

Line 2

Schedules RK-1

All taxable interest income must be

reported. If the estate or trust has

Total Interest Income

If the estate or trust is an owner of

Pennsylvania-taxable interest income

an S corporation or entity formed as

Add all amounts listed from Line 1

that is more than $2,500, PA-41

a limited liability company that is

including amounts on additional

Schedule A must be completed

classified as a S corporation for

schedules.

indicating the name of each payer

federal income tax purposes, the

and amount of Pennsylvania-taxable

estate or trust will receive a PA-

Line 3

interest of the payer from each

20S/PA-65 Schedule RK-1 showing

Interest Income from

federal Form 1099-INT or other

its share of any interest income.

statement.

Partnerships from PA

Report the amount of any interest

Pennsylvania-taxable interest

income from PA-20S/PA-65 Schedule

Schedules RK-1

income includes interest from:

RK-1, Line 2 on PA-41 Schedule A,

If the estate or trust is a partner in a

●

Savings and loan associations;

Line 3 or Line 4.

partnership or a member in an entity

●

Credit unions, even if reported as

Submit all such schedules to

formed as a limited liability company

dividends on your statement;

support the amount reported on PA-

that is classified as a partnership for

●

41 Schedule A. Include a copy of

Bank deposits;

federal income tax purposes, the

federal Form 1120S Schedule K-1 if a

●

Bonds (except as noted below);

estate or trust will receive a PA-

PA-20S/PA-65 Schedule RK-1 is not

●

Certificates of deposit;

20S/PA-65 Schedule RK-1 showing

supplied by the S corporation or

●

Interest-bearing personal checking

its share of any interest income.

entity formed as a limited liability

accounts;

Report the amount of any interest

company that is classified as a S

income from PA-20S/PA-65 Schedule

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2