Package X - New Hampshirebusiness Tax Forms - 2010 Page 2

ADVERTISEMENT

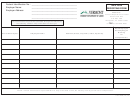

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

TABLE OF CONTENTS

ITEM NAME

DESCRIPTION

PAGE(S)

BT-EXT

Payment Form, Application and Instructions for Extension of Time to File for all Businesses

1

BT-SUMMARY

Business Tax Summary Form for all Businesses

2

BET Credit Worksheet

BET Credit Worksheet

3

BET

Business Enterprise Tax Return (not for Proprietorships)

4

BET-PROP

Business Enterprise Tax Return for Proprietorships

5

BET-80

Business Enterprise Tax Apportionment (for all businesses except Combined Groups)

6

BET-80-WE

Business Enterprise Tax Apportionment for Combined Groups

7

DP-9

Small Business Corporations (S-Corp), Partnership & LLC Information Report and Instructions

8

DP-80 Schedule A

Business Profi ts Tax Apportionment Schedule A

9

DP-120 Schedule S

Computation of "S" Corporation Gross Business Profi ts and Instructions

10

NOL WORKSHEET

Worksheet for Apportionment of Net Operating Loss and Instructions

11

DP-132

Net Operating Loss (NOL) Deduction Form and Instructions (not for Combined Groups)

12

DP-132-WE

Net Operating Loss (NOL) Deduction for Combined Groups

13

DP-160

Schedule and Instructions for Business Profi ts Tax Credits

14

DP-160-WE

Schedule and Instructions for Business Profi ts Tax Credits for Combined Groups

15

NH-ES-WS

Estimated Business Tax Worksheet, Computation & Record of Payments

16

NH-BET-ES

Estimated Business Enterprise Tax Vouchers

17

NH-BPT-ES

Estimated Business Profi ts Tax Vouchers

19

NH-1040

Proprietorship Business Profi ts Tax Return

21

PROP-COMP

Proprietorship Business Profi ts Tax Personal Compensation Deduction Worksheet

22

NH-1041

Fiduciary Business Profi ts Tax Return

23

NH-1065

Partnership Business Profi ts Tax Return

24

PART-COMP

Partnership Business Profi ts Tax Personal Compensation Deduction Worksheet

25

Schedule R

Gross Business Profi ts Reconciliation

26

NH-1120

Corporate Business Profi ts Tax Return

27

NH-1120-WE

Combined Business Profi ts Tax Return

28

NH-1120-WE Affi liation Schedule

Combined Business Profi ts Tax Affi liation Schedule for all Combined Businesses

29

NH-1120-WE Schedule I

Summary of Combined Net Income Schedule I and Instructions

30

NH-1120-WE Schedule II

Apportionment of Foreign Dividends Schedule II

31

NH-1120-WE Schedule III

Foreign Dividend Factor Increments Schedule III

32

DP-2848

Power of Attorney & Instructions

33

DP-2210/2220

Exceptions and Penalty for the Underpayment of Estimated Tax

34

INSTRUCTIONS

DP-2210/2220

Exceptions and Penalty for the Underpayment of Estimated Tax Instructions

35

BT General

General Instructions for fi ling Business Taxes

36

BT-Summary

Business Tax Summary Instructions for all Businesses

38

BET & BET-PROP

Business Enterprise Tax Return Instructions

39

BET-Checklist

Checklist for Business Enterprise Tax Dividends Compensation and Interest

40

BET-80 & BET-80-WE

Business Enterprise Tax Apportionment Instructions (all businesses, including Combined Groups)

42

DP-80 Schedule A

Business Profi ts Tax Apportionment Schedule A Instructions

44

NH-1040

Proprietorship Business Profi ts Tax Return Instructions

45

NH-1041

Fiduciary Business Profi ts Tax Return Instructions

47

NH-1065

Partnership Business Profi ts Tax Return Instructions

48

Schedule R

Gross Business Profi ts Reconciliations Instructions

50

NH-1120

Corporate Business Profi ts Tax Return Instructions

51

NH-1120-WE

Combined Business Profi ts Tax Return and Affi liation Schedule Instructions for all Combined Businesses

52

NH-1120-WE Schedule II

Apportionment of Foreign Dividends Schedule II Instructions

53

NH-1120-WE Schedule III

Foreign Dividend Factor Increments Schedule III Instructions

54

Estimates

Instructions for all Business Tax Estimates

55

TOC

Rev 09/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5