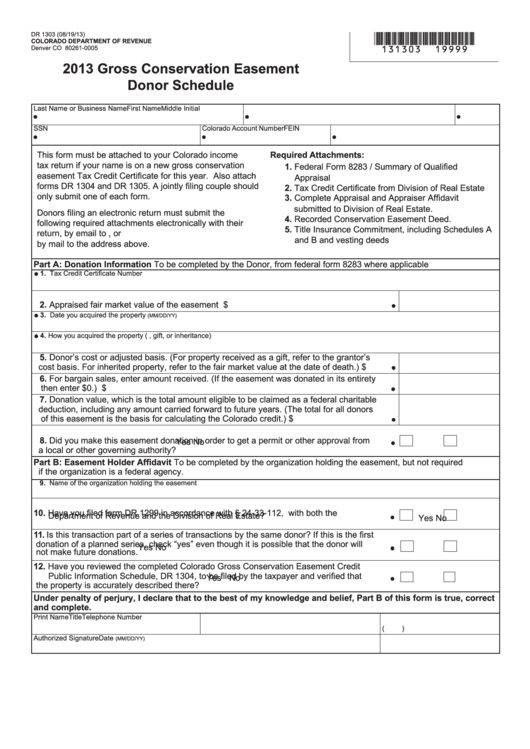

DR 1303 (08/19/13)

*131303==19999*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

2013 Gross Conservation Easement

Donor Schedule

Last Name or Business Name

First Name

Middle Initial

SSN

Colorado Account Number

FEIN

Required Attachments:

This form must be attached to your Colorado income

tax return if your name is on a new gross conservation

1. Federal Form 8283 / Summary of Qualified

easement Tax Credit Certificate for this year. Also attach

Appraisal

forms DR 1304 and DR 1305. A jointly filing couple should

2. Tax Credit Certificate from Division of Real Estate

only submit one of each form.

3. Complete Appraisal and Appraiser Affidavit

submitted to Division of Real Estate.

Donors filing an electronic return must submit the

4. Recorded Conservation Easement Deed.

following required attachments electronically with their

5. Title Insurance Commitment, including Schedules A

return, by email to DOR_GCEInformation@state.co.us, or

and B and vesting deeds

by mail to the address above.

Part A: Donation Information To be completed by the Donor, from federal form 8283 where applicable

1. Tax Credit Certificate Number

2. Appraised fair market value of the easement

$

3. Date you acquired the property

(MM/DD/YY)

4. How you acquired the property (e.g. purchase, gift, or inheritance)

5. Donor’s cost or adjusted basis. (For property received as a gift, refer to the grantor’s

cost basis. For inherited property, refer to the fair market value at the date of death.)

$

6. For bargain sales, enter amount received. (If the easement was donated in its entirety

then enter $0.)

$

7. Donation value, which is the total amount eligible to be claimed as a federal charitable

deduction, including any amount carried forward to future years. (The total for all donors

of this easement is the basis for calculating the Colorado credit.)

$

8. Did you make this easement donation in order to get a permit or other approval from

Yes

No

a local or other governing authority?

Part B: Easement Holder Affidavit To be completed by the organization holding the easement, but not required

if the organization is a federal agency.

9. Name of the organization holding the easement

10. Have you filed form DR 1299 in accordance with § 24-33-112, C.R.S. with both the

Yes

No

Department of Revenue and the Division of Real Estate?

11. Is this transaction part of a series of transactions by the same donor? If this is the first

donation of a planned series, check “yes” even though it is possible that the donor will

Yes

No

not make future donations.

12. Have you reviewed the completed Colorado Gross Conservation Easement Credit

Public Information Schedule, DR 1304, to be filed by the taxpayer and verified that

Yes

No

the property is accurately described there?

Under penalty of perjury, I declare that to the best of my knowledge and belief, Part B of this form is true, correct

and complete.

Print Name

Title

Telephone Number

(

)

Authorized Signature

Date

(MM/DD/YY)

1

1