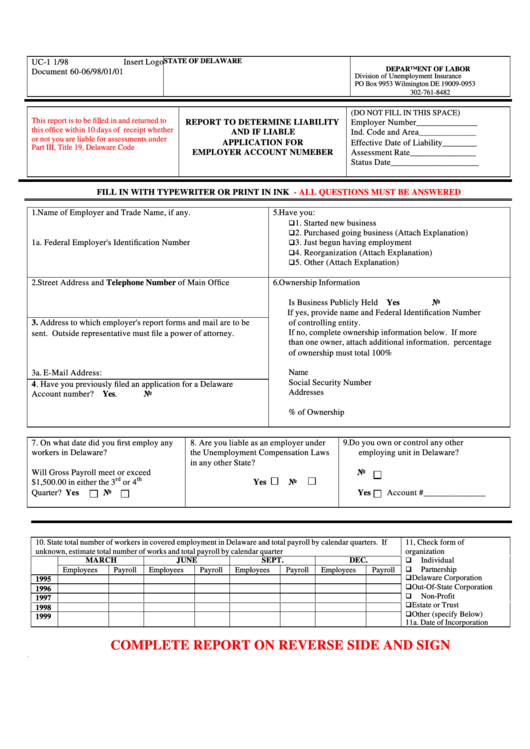

Form Uc-1 - Report To Determine Liability And If Liable Application For Employer Account Numeber

ADVERTISEMENT

UC-1 1/98

Insert Logo

STATE OF DELAWARE

DEPARTMENT OF LABOR

Document 60-06/98/01/01

Division of Unemployment Insurance

PO Box 9953 Wilmington DE 19009-0953

302-761-8482

)

(DO NOT FILL IN THIS SPACE

This report is to be filled in and returned to

REPORT TO DETERMINE LIABILITY

Employer Number______________

this office within 10 days of receipt whether

AND IF LIABLE

Ind. Code and Area_____________

or not you are liable for assessments under

APPLICATION FOR

Effective Date of Liability________

Part III, Title 19, Delaware Code

EMPLOYER ACCOUNT NUMEBER

Assessment Rate_______________

Status Date____________________

FILL IN WITH TYPEWRITER OR PRINT IN INK

- ALL QUESTIONS MUST BE ANSWERED

1.

Name of Employer and Trade Name, if any.

5.

Have you:

q

1. Started new business

q

2. Purchased going business (Attach Explanation)

q

1a. Federal Employer's Identification Number

3. Just begun having employment

q

4. Reorganization (Attach Explanation)

q

5. Other (Attach Explanation)

2.

Street Address and Telephone Number of Main Office

6.

Ownership Information

Is Business Publicly Held Yes

No

If yes, provide name and Federal Identification Number

3. Address to which employer's report forms and mail are to be

of controlling entity.

If no, complete ownership information below. If more

sent. Outside representative must file a power of attorney.

than one owner, attach additional information. percentage

of ownership must total 100%

Name

3a. E-Mail Address:

Social Security Number

4. Have you previously filed an application for a Delaware

Addresses

Account number?

Yes.

No

% of Ownership

7. On what date did you first employ any

8. Are you liable as an employer under

9.

Do you own or control any other

workers in Delaware?

the Unemployment Compensation Laws

employing unit in Delaware?

in any other State?

Will Gross Payroll meet or exceed

No

rd

th

$1,500.00 in either the 3

or 4

Yes

No

Quarter? Yes

No

Yes

Account #______________

10. State total number of workers in covered employment in Delaware and total payroll by calendar quarters. If

11, Check form of

unknown, estimate total number of works and total payroll by calendar quarter

organization

q

MARCH

JUNE

SEPT.

DEC.

Individual

q

Partnership

Employees

Payroll

Employees

Payroll

Employees

Payroll

Employees

Payroll

q

Delaware Corporation

1995

q

Out-Of-State Corporation

1996

q

Non-Profit

1997

q

Estate or Trust

1998

q

Other (specify Below)

1999

11a. Date of Incorporation

COMPLETE REPORT ON REVERSE SIDE AND SIGN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2