Form Ct-706/709 Ext Instructions - State Of Connecticut

ADVERTISEMENT

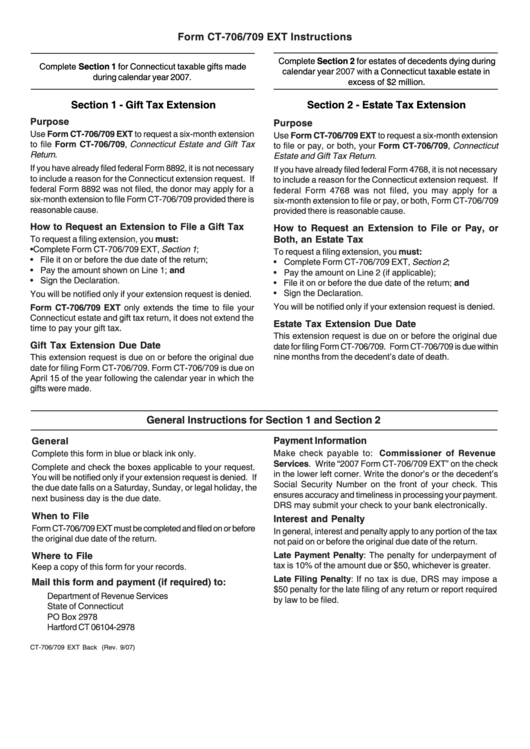

Form CT-706/709 EXT Instructions

Complete Section 2 for estates of decedents dying during

Complete Section 1 for Connecticut taxable gifts made

calendar year

2007

with a Connecticut taxable estate in

during calendar year 2007.

excess of $2 million.

Section 1 - Gift Tax Extension

Section 2 - Estate Tax Extension

Purpose

Purpose

Use Form CT-706/709 EXT to request a six-month extension

Use Form CT-706/709 EXT to request a six-month extension

to file Form CT-706/709, Connecticut Estate and Gift Tax

to file or pay, or both, your Form CT-706/709, Connecticut

Return.

Estate and Gift Tax Return.

If you have already filed federal Form 8892, it is not necessary

If you have already filed federal Form 4768, it is not necessary

to include a reason for the Connecticut extension request. If

to include a reason for the Connecticut extension request. If

federal Form 8892 was not filed, the donor may apply for a

federal Form 4768 was not filed, you may apply for a

six-month extension to file Form CT-706/709 provided there is

six-month extension to file or pay, or both, Form CT-706/709

reasonable cause.

provided there is reasonable cause.

How to Request an Extension to File a Gift Tax

How to Request an Extension to File or Pay, or

To request a filing extension, you must:

Both, an Estate Tax

• Complete Form CT-706/709 EXT, Section 1;

To request a filing extension, you must:

• File it on or before the due date of the return;

• Complete Form CT-706/709 EXT, Section 2;

• Pay the amount shown on Line 1; and

• Pay the amount on Line 2 (if applicable);

• Sign the Declaration.

• File it on or before the due date of the return; and

• Sign the Declaration.

You will be notified only if your extension request is denied.

You will be notified only if your extension request is denied.

Form CT-706/709 EXT only extends the time to file your

Connecticut estate and gift tax return, it does not extend the

Estate Tax Extension Due Date

time to pay your gift tax.

This extension request is due on or before the original due

Gift Tax Extension Due Date

date for filing Form CT-706/709. Form CT-706/709 is due within

nine months from the decedent’s date of death.

This extension request is due on or before the original due

date for filing Form CT-706/709. Form CT-706/709 is due on

April 15 of the year following the calendar year in which the

gifts were made.

General Instructions for Section 1 and Section 2

General

Payment Information

Complete this form in blue or black ink only.

Make check payable to: Commissioner of Revenue

Services. Write “2007 Form CT-706/709 EXT” on the check

Complete and check the boxes applicable to your request.

in the lower left corner. Write the donor’s or the decedent’s

You will be notified only if your extension request is denied. If

Social Security Number on the front of your check. This

the due date falls on a Saturday, Sunday, or legal holiday, the

ensures accuracy and timeliness in processing your payment.

next business day is the due date.

DRS may submit your check to your bank electronically.

When to File

Interest and Penalty

Form CT-706/709 EXT must be completed and filed on or before

In general, interest and penalty apply to any portion of the tax

the original due date of the return.

not paid on or before the original due date of the return.

Where to File

Late Payment Penalty: The penalty for underpayment of

tax is 10% of the amount due or $50, whichever is greater.

Keep a copy of this form for your records.

Late Filing Penalty: If no tax is due, DRS may impose a

Mail this form and payment (if required) to:

$50 penalty for the late filing of any return or report required

Department of Revenue Services

by law to be filed.

State of Connecticut

PO Box 2978

Hartford CT 06104-2978

CT-706/709 EXT Back (Rev. 9/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1