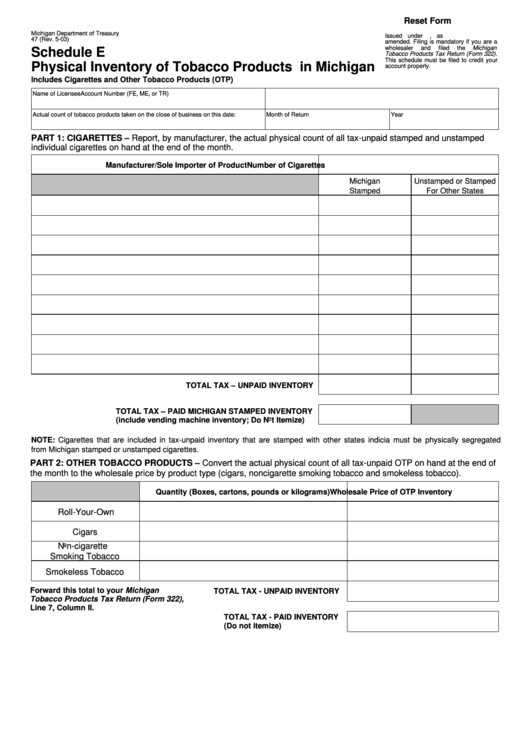

Form 47 Schedule E - Physical Inventory Of Tobacco Products In Michigan

ADVERTISEMENT

Reset Form

Michigan Department of Treasury

Issued under P.A. 327 of 1993, as

47 (Rev. 5-03)

amended. Filing is mandatory if you are a

wholesaler

and

filed

the

Michigan

Schedule E

Tobacco Products Tax Return (Form 322).

This schedule must be filed to credit your

Physical Inventory of Tobacco Products in Michigan

account properly.

Includes Cigarettes and Other Tobacco Products (OTP)

Name of Licensee

Account Number (FE, ME, or TR)

Actual count of tobacco products taken on the close of business on this date:

Month of Return

Year

PART 1: CIGARETTES – Report, by manufacturer, the actual physical count of all tax-unpaid stamped and unstamped

individual cigarettes on hand at the end of the month.

Manufacturer/Sole Importer of Product

Number of Cigarettes

Michigan

Unstamped or Stamped

Stamped

For Other States

TOTAL TAX – UNPAID INVENTORY

TOTAL TAX – PAID MICHIGAN STAMPED INVENTORY

(include vending machine inventory; Do Not Itemize)

NOTE: Cigarettes that are included in tax-unpaid inventory that are stamped with other states indicia must be physically segregated

from Michigan stamped or unstamped cigarettes.

PART 2: OTHER TOBACCO PRODUCTS – Convert the actual physical count of all tax-unpaid OTP on hand at the end of

the month to the wholesale price by product type (cigars, noncigarette smoking tobacco and smokeless tobacco).

Quantity (Boxes, cartons, pounds or kilograms)

Wholesale Price of OTP Inventory

Roll-Your-Own

Cigars

Non-cigarette

Smoking Tobacco

Smokeless Tobacco

Forward this total to your Michigan

TOTAL TAX - UNPAID INVENTORY

Tobacco Products Tax Return (Form 322),

Line 7, Column II.

TOTAL TAX - PAID INVENTORY

(Do not itemize)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1