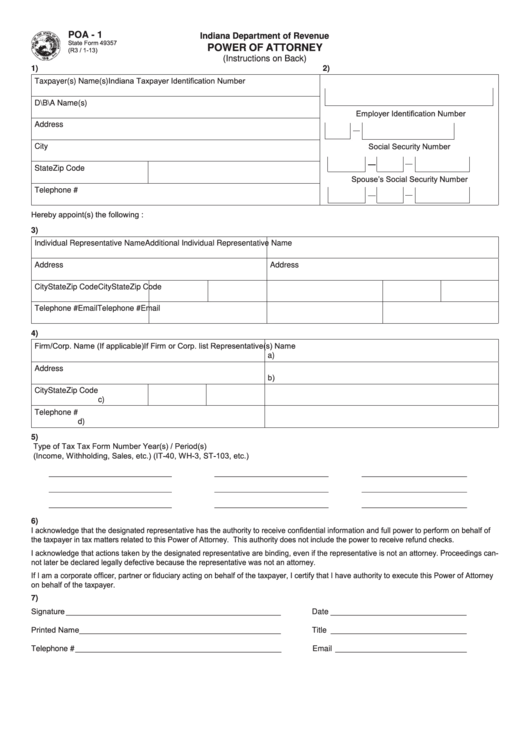

POA - 1

Indiana Department of Revenue

State Form 49357

POWER OF ATTORNEY

(R3 / 1-13)

(Instructions on Back)

1)

2)

Indiana Taxpayer Identification Number

Taxpayer(s) Name(s)

D\B\A Name(s)

Employer Identification Number

Address

Social Security Number

City

State

Zip Code

Spouse’s Social Security Number

Telephone #

Hereby appoint(s) the following :

3)

Individual Representative Name

Additional Individual Representative Name

Address

Address

City

State

Zip Code

City

State

Zip Code

Telephone #

Email

Telephone #

Email

4)

Firm/Corp. Name (If applicable)

If Firm or Corp. list Representative(s) Name

a)

Address

b)

City

State

Zip Code

c)

Telephone #

d)

5)

Type of Tax

Tax Form Number

Year(s) / Period(s)

(Income, Withholding, Sales, etc.)

(IT-40, WH-3, ST-103, etc.)

____________________________

__________________________

________________________

____________________________

__________________________

________________________

____________________________

__________________________

________________________

6)

I acknowledge that the designated representative has the authority to receive confidential information and full power to perform on behalf of

the taxpayer in tax matters related to this Power of Attorney. This authority does not include the power to receive refund checks.

I acknowledge that actions taken by the designated representative are binding, even if the representative is not an attorney. Proceedings can-

not later be declared legally defective because the representative was not an attorney.

If I am a corporate officer, partner or fiduciary acting on behalf of the taxpayer, I certify that I have authority to execute this Power of Attorney

on behalf of the taxpayer.

7)

Signature _________________________________________________

Date _______________________________

Printed Name ______________________________________________

Title _______________________________

Telephone # _______________________________________________

Email ______________________________

1

1 2

2