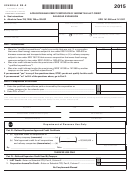

Schedule Rr-E (Form 41a720rr-E) - Application And Credit Certificate Of Income Tax/llet Credit Railroad Expansion Page 2

ADVERTISEMENT

41A720RR–E (10–11)

Page 2

INSTRUCTIONS FOR SCHEDULE RR–E

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

The railroad expansion credit provided by KRS 141.386 is a nonrefundable credit that can be applied against the taxes imposed

by KRS 141.040 and KRS 141.0401. The tax credit shall be used in the tax year of the qualified expenditures which generated the

tax credit and cannot be carried forward to a return for any other period. If a qualified expenditure qualifies for both the railroad

maintenance and improvement credit as provided by KRS 141.385 and the railroad expansion tax credit as provided by KRS 141.386,

the taxpayer must claim either the credit provided by KRS 141.385 or the credit provided by KRS 141.386, but not both.

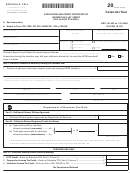

Purpose of Schedule— This schedule is used to compute the

General Instructions—Enter the calendar year in applicable

railroad expansion credit. An eligible taxpayer means: (i) a

boxes.

corporation that owns fossil energy resources subject to tax

Enter the name, mailing address and business location address

under KRS 143.020 or 143A.020 or biomass resources and

in applicable boxes. Enter the Federal Identification Number

transports these resources using rail facilities; or (ii) a railway

and Kentucky Corporation/LLET Account Number in applicable

company subject to tax under KRS 136.120 that serves a

boxes. Check the appropriate entity type.

corporation that owns fossil energy resources subject to tax

under KRS 143.020 or 143A.020 or biomass resources.

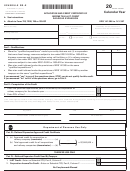

This application must be signed and dated by an authorized

corporate officer (if filing Form 720 or 720S) or partner or

Fossil energy resources means reserves of coal, oil shale,

member (if filing Form 765 or 765–GP).

and natural gas; and biomass resources means agriculture

materials that may be used for production of transportation

Part I—Qualifications

fuels such as biodiesel or ethanol or that may themselves be

The tax credit provided by KRS 141.386 shall be claimed in

used as a fuel, alone or in combination with a fossil fuel, for

the tax year that the qualified expenditures are paid or in-

generation of electricity.

curred by the eligible taxpayer. You must be: (i) a corporation

that owns fossil energy resources subject to tax under KRS

The railroad expansion tax credit is an amount equal to 25% of

143.020 or 143A.020 or biomass resources and transports

the qualified expenditures paid or incurred by the corporation

these resources using rail facilities; or (ii) a railway company

or railway company during the tax year to expand or upgrade

subject to tax under KRS 136.120 that serves a corporation

railroad track, including roadbeds, bridges, and related track

that owns fossil energy resources subject to tax under KRS

structures, to accommodate the transport of fossil energy

143.020 or 143A.020 or biomass resources. If you have taken

resources or biomass resources.

the railroad maintenance and improvement tax credit per-

The credit amount approved for a calendar year for all

mitted by KRS 141.385 on the same qualified expenditures,

taxpayers under KRS 141.386 shall be limited to $1,000,000.

you do not qualify for this credit. If a tax credit was claimed

If the total amount of approved credit exceeds $1,000,000,

under the provisions of KRS 141.385 or 141.386 by another

the department shall determine the amount of credit each

taxpayer on the same qualified expenditures, you do not

corporation and railway company receives by multiplying the

qualify for this credit.

$1,000,000 by a fraction, the numerator of which is the amount

Part II—Computation of the Credit

of the approved credit for a corporation or railway company

and the denominator of which is the total approved credit for

Line 1—Enter the “qualified expenditures” paid or incurred

all corporations and railway companies.

by the corporation or railway company for the calendar year.

Qualified expenditures are expenditures paid or incurred to

Each corporation or railway company eligible for the credit

expand or upgrade railroad track, including roadbeds, bridges,

shall file a railroad expansion tax credit claim on this form by

and related track structures, to accommodate the transport of

the fifteenth day of the first month following the close of the

fossil energy resources or biomass resources.

preceding calendar year.

Line 2—Enter twenty–five percent (25%) of Line 1.

To ensure proper processing, fax or email Schedule RR-E

to the Department of Revenue no later than January 15 fol-

Part III—Railroad Expansion Approved Credit Certificate

lowing the close of the preceding calendar year. Schedules

The Department of Revenue determines each corporation’s

postmarked or sent after January 15 are void. Credit certi-

or railway company’s approved credit. If the total approved

fication cannot be guaranteed for schedules sent through

credit for all corporations and railway companies exceeds

regular mail.

the railroad expansion tax credit cap of $1,000,000 for the

calendar year, the department shall determine the amount

of credit each corporation or railway company receives by

Fax number: (502) 564–0058

multiplying the $1,000,000 by a fraction, the numerator (Line

1(a)) of which is the amount of the approved credit for a

Email address:

corporation or railway company and the denominator (Line

KRC.WEBResponseEconomicDevelopmentCredits@ky.gov

1(b)) of which is the total approved credit for all corporations

and railway companies.

Part IV—Railroad Expansion Credit Used By Taxpayer

The Department of Revenue will confirm the receipt of the

application. If you do not receive confirmation within two weeks

Line 1—Enter the amount of the credit claimed for the taxable

of submitting the application, contact the Division of Corporation

year against the LLET on Schedule TCS, Part II, Column E.

Tax at (502) 564–8139.

The credit amount cannot reduce the LLET below the $175

minimum.

The Department of Revenue will issue the credit certificate,

listing the amount of credit, by March 15 following the close

Line 2—Enter the amount of the credit claimed for the taxable

of the preceding calendar year. Attach the credit certificate

year against the corporation income tax on Schedule TCS, Part

(Schedule RR–E) to the tax return claiming the credit.

II, Column F .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2