F

2

ORM

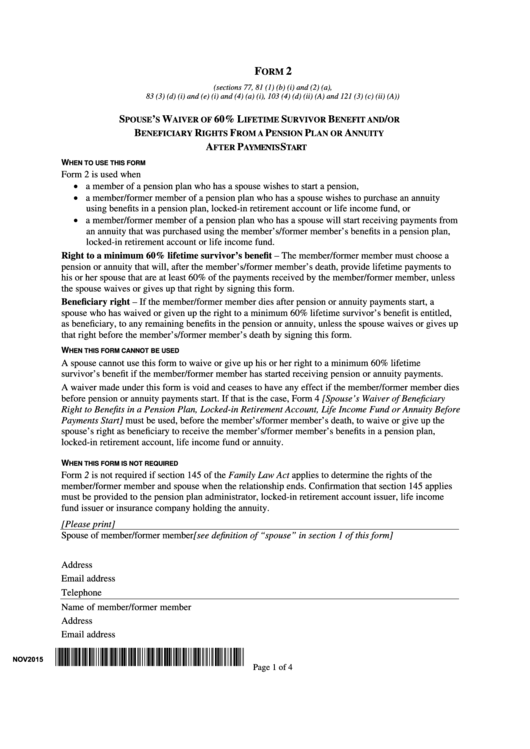

(sections 77, 81 (1) (b) (i) and (2) (a),

83 (3) (d) (i) and (e) (i) and (4) (a) (i), 103 (4) (d) (ii) (A) and 121 (3) (c) (ii) (A))

S

’

W

60% L

S

B

/

POUSE

S

AIVER OF

IFETIME

URVIVOR

ENEFIT AND

OR

B

R

F

P

P

A

ENEFICIARY

IGHTS

ROM A

ENSION

LAN OR

NNUITY

A

P

S

FTER

AYMENTS

TART

W

HEN TO USE THIS FORM

Form 2 is used when

a member of a pension plan who has a spouse wishes to start a pension,

a member/former member of a pension plan who has a spouse wishes to purchase an annuity

using benefits in a pension plan, locked-in retirement account or life income fund, or

a member/former member of a pension plan who has a spouse will start receiving payments from

an annuity that was purchased using the member’s/former member’s benefits in a pension plan,

locked-in retirement account or life income fund.

Right to a minimum 60% lifetime survivor’s benefit – The member/former member must choose a

pension or annuity that will, after the member’s/former member’s death, provide lifetime payments to

his or her spouse that are at least 60% of the payments received by the member/former member, unless

the spouse waives or gives up that right by signing this form.

Beneficiary right – If the member/former member dies after pension or annuity payments start, a

spouse who has waived or given up the right to a minimum 60% lifetime survivor’s benefit is entitled,

as beneficiary, to any remaining benefits in the pension or annuity, unless the spouse waives or gives up

that right before the member’s/former member’s death by signing this form.

W

HEN THIS FORM CANNOT BE USED

A spouse cannot use this form to waive or give up his or her right to a minimum 60% lifetime

survivor’s benefit if the member/former member has started receiving pension or annuity payments.

A waiver made under this form is void and ceases to have any effect if the member/former member dies

before pension or annuity payments start. If that is the case, Form 4 [Spouse’s Waiver of Beneficiary

Right to Benefits in a Pension Plan, Locked-in Retirement Account, Life Income Fund or Annuity Before

Payments Start] must be used, before the member’s/former member’s death, to waive or give up the

spouse’s right as beneficiary to receive the member’s/former member’s benefits in a pension plan,

locked-in retirement account, life income fund or annuity.

W

HEN THIS FORM IS NOT REQUIRED

Form 2 is not required if section 145 of the Family Law Act applies to determine the rights of the

member/former member and spouse when the relationship ends. Confirmation that section 145 applies

must be provided to the pension plan administrator, locked-in retirement account issuer, life income

fund issuer or insurance company holding the annuity.

[Please print]

Spouse of member/former member [see definition of “spouse” in section 1 of this form]

Name..............................................................................................................................................................

Address .........................................................................................................................................................

Email address ................................................................................................................................................

Telephone .....................................................................................................................................................

Name of member/former member ................................................................................................................

Address .........................................................................................................................................................

Email address ................................................................................................................................................

*CSI_OPS_LCK_zzz*

NOV2015

Page 1 of 4

1

1 2

2 3

3 4

4