Instructions For Form 5452 - Corporate Report Of Nondividend Distributions

ADVERTISEMENT

2

Form 5452 (Rev. 10-2016)

Page

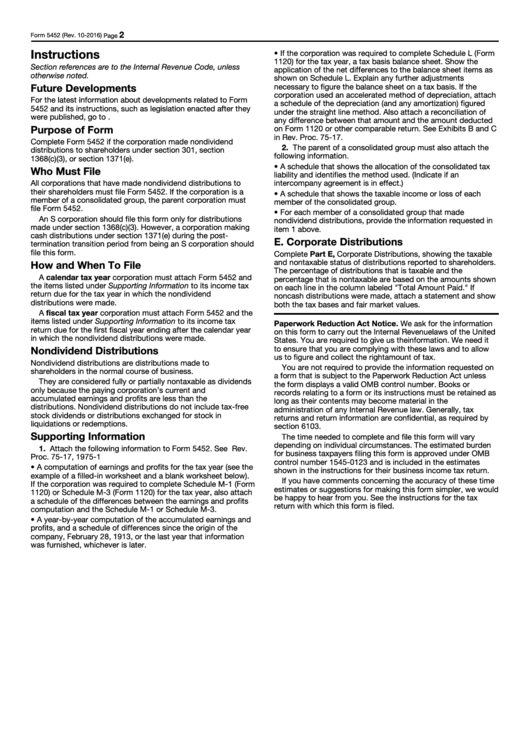

Instructions

• If the corporation was required to complete Schedule L (Form

1120) for the tax year, a tax basis balance sheet. Show the

Section references are to the Internal Revenue Code, unless

application of the net differences to the balance sheet items as

otherwise noted.

shown on Schedule L. Explain any further adjustments

Future Developments

necessary to figure the balance sheet on a tax basis. If the

corporation used an accelerated method of depreciation, attach

For the latest information about developments related to Form

a schedule of the depreciation (and any amortization) figured

5452 and its instructions, such as legislation enacted after they

under the straight line method. Also attach a reconciliation of

were published, go to

any difference between that amount and the amount deducted

Purpose of Form

on Form 1120 or other comparable return. See Exhibits B and C

in Rev. Proc. 75-17.

Complete Form 5452 if the corporation made nondividend

2. The parent of a consolidated group must also attach the

distributions to shareholders under section 301, section

following information.

1368(c)(3), or section 1371(e).

• A schedule that shows the allocation of the consolidated tax

Who Must File

liability and identifies the method used. (Indicate if an

All corporations that have made nondividend distributions to

intercompany agreement is in effect.)

their shareholders must file Form 5452. If the corporation is a

• A schedule that shows the taxable income or loss of each

member of a consolidated group, the parent corporation must

member of the consolidated group.

file Form 5452.

• For each member of a consolidated group that made

An S corporation should file this form only for distributions

nondividend distributions, provide the information requested in

made under section 1368(c)(3). However, a corporation making

item 1 above.

cash distributions under section 1371(e) during the post-

E. Corporate Distributions

termination transition period from being an S corporation should

file this form.

Complete Part E, Corporate Distributions, showing the taxable

and nontaxable status of distributions reported to shareholders.

How and When To File

The percentage of distributions that is taxable and the

A calendar tax year corporation must attach Form 5452 and

percentage that is nontaxable are based on the amounts shown

the items listed under Supporting Information to its income tax

on each line in the column labeled "Total Amount Paid." If

return due for the tax year in which the nondividend

noncash distributions were made, attach a statement and show

distributions were made.

both the tax bases and fair market values.

A fiscal tax year corporation must attach Form 5452 and the

items listed under Supporting Information to its income tax

Paperwork Reduction Act Notice. We ask for the information

return due for the first fiscal year ending after the calendar year

on this form to carry out the Internal Revenue laws of the United

in which the nondividend distributions were made.

States. You are required to give us the information. We need it

to ensure that you are complying with these laws and to allow

Nondividend Distributions

us to figure and collect the right amount of tax.

Nondividend distributions are distributions made to

You are not required to provide the information requested on

shareholders in the normal course of business.

a form that is subject to the Paperwork Reduction Act unless

They are considered fully or partially nontaxable as dividends

the form displays a valid OMB control number. Books or

only because the paying corporation’s current and

records relating to a form or its instructions must be retained as

accumulated earnings and profits are less than the

long as their contents may become material in the

distributions. Nondividend distributions do not include tax-free

administration of any Internal Revenue law. Generally, tax

stock dividends or distributions exchanged for stock in

returns and return information are confidential, as required by

liquidations or redemptions.

section 6103.

Supporting Information

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated burden

1. Attach the following information to Form 5452. See Rev.

for business taxpayers filing this form is approved under OMB

Proc. 75-17, 1975-1 C.B. 677.

control number 1545-0123 and is included in the estimates

• A computation of earnings and profits for the tax year (see the

shown in the instructions for their business income tax return.

example of a filled-in worksheet and a blank worksheet below).

If you have comments concerning the accuracy of these time

If the corporation was required to complete Schedule M-1 (Form

estimates or suggestions for making this form simpler, we would

1120) or Schedule M-3 (Form 1120) for the tax year, also attach

be happy to hear from you. See the instructions for the tax

a schedule of the differences between the earnings and profits

return with which this form is filed.

computation and the Schedule M-1 or Schedule M-3.

• A year-by-year computation of the accumulated earnings and

profits, and a schedule of differences since the origin of the

company, February 28, 1913, or the last year that information

was furnished, whichever is later.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3